Gas asli adalah tiang seri ekonomi Eropah.

2020-04-13 • Dikemaskini

The world’s top oil producers pulled off a historic deal to cut global petroleum output by nearly a 10th, and they considered this deal as an end to the devastating price war that brought the energy industry to its knees. However, crude oil isn’t inspired by the news much as its price has been drifting lower since the beginning of the Asian session.

In short, no it’s not. Today, Saudi Aramco announced that it cuts all May oil pricing to Asia. In addition it raises May oil pricing to the US by $2.50-$4.20/BBL.

Reading the history is very important when it comes to crude oil trends. Everyone is asking the same question now: will the price of oil skyrocket again? In short, the answer is no.

The deal that was signed after Saudi Arabia called for an emergency meeting to discuss oil prices will lead to some stabilization and/or will at least stop the crash, but it won’t necessarily help crude oil skyrocket.

This is exactly what happened back in 2015 and 2016 when the prices crashed and OPEC was forced to stop the crash by cutting the output after verbal statements failed to stop the crash.

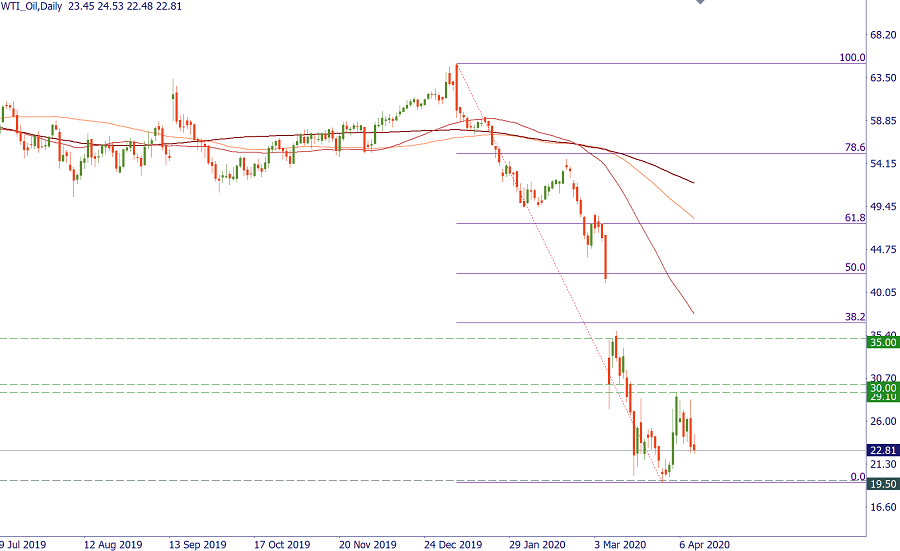

From a technical point of view, Brent crude has been trading within a tight range after retracing 23.6% from the latest crash as shown on the chart and failed to continue with its retracement. Yet, the current declines might continue all the way back to 27.28 key support, which likely to hold over the next few weeks.

WTI has almost the same scenario, but WTI technical outlook is more bearish than Brent for now. WTI failed to retrace by 23.6% and declined before testing it all the way back to $23 earlier today. We believe that the key support for WTI stands at $21.50. A break below this support would lead to another leg lower once again back to 19.27.

Traders needs to be careful over the next few days and weeks. There is no need to overestimate the next move whether it’s higher or lower. The deal that was announced is supposed to stabilize the market, it doesn’t mean that oil will skyrocket once again especially as the global economy is suffering amid the global lockdown due to the coronavirus pandemic. Therefore, if the prices stabilize, it will be a perfect opportunity to pick up some trades from the technical analysis point of view.

Gas asli adalah tiang seri ekonomi Eropah.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!