Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

2019-11-11 • Dikemaskini

The Brazilian real faced a real challenge during the last couple of days. The USD/BRL pair jumped above the 4 level on Friday and tested the last September highs above 4.11. The reasons behind this weakness lie in the combination of negative factors surrounding Brazil. What are these factors? Will the currency strengthen?

Everything started with the escalation of the trade war between the US and China. After the rise of tariffs applied to Chinese imports, US sanctions on the Chinese telecommunication firms, such as Huawei, and announced countermeasures by the Chinese side, the risky mood across the markets faded away. It affected the emerging market currencies, which include the BRL.

However, the news from the US-China trade war front was not the main issue which has been adding pressure on the Brazilian currency. Las week, the major banks cut their growth forecasts for Brazil. Goldman Sachs changed its forecast for the first quarter GDP growth from 0.2% to -0.1%. Bank of Amerika Merrill Lynch, Barclays and BNP Paribas were also among the banks which slashed their growth projections.

The revised forecasts reflect president Jair Bolsonaro’s failure to provide any significant changes to the economy. Despite his promises to cut the country’s debt and to get Brazil out of the recession, the economy continues to slow down with the unemployment rate reaching the highest level of 12.7% since May 2018. At the same time, the level of industrial production fell by 1.3% in March 2019. The figures demonstrate that the economy is far away from the recovery.

In addition, the famous pension reform has stuck for now. It was expected to boost the economy and save over a trillion Brazilian reals (about $250 billion). Now investors are questioning the president’s ability to implement the reforms he was so confident about. For now, the unratified government decrees worth billions of dollars lay on the table and are about to expire unless the Congress approves them on June 3.

The central bank of Brazil also relies on the government’s decisions. It has been holding its interest rate for the record low of 6% for about a year and will continue to do it unless the outlook will change.

So, what may support the Brazilian currency?

Technical outlook into the USD/BRL pair

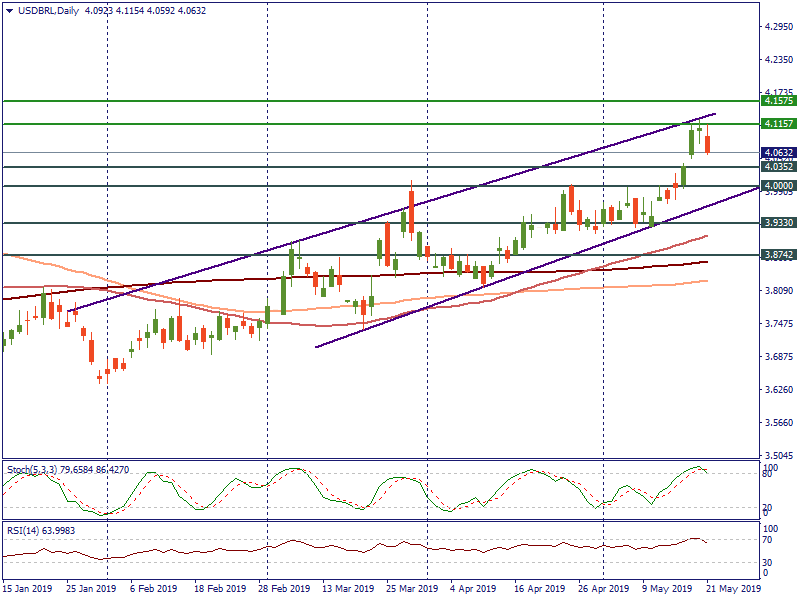

On Monday, USD/BRL bounced from the upper border of the ascending trading channel near the 4.1157 level. At the moment, it is going through correction towards the support at 4.0352. If this level is broken, the next support to watch lies at 4.0352. On the flipside, the bullish scenario will help the pair to break the resistance at 4.1157 and rise to the September 2018 highs with the next resistance placed at 4.1575.

RSI has left the overbought zone and stochastic indicator formed a crossover there, which may signal a selling opportunity.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Penghujung tahun semakin hampir Apakah yang akan dibawakan oleh 2021 kepada kita? Jom ketahui apakah jangkaan di fikiran bank-bank besar!

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!