Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

2021-10-29 • Dikemaskini

On October 28 European Central Bank held a press conference. Inflation has hit Europe and now the time has come for more profound steps in the fight with the post-pandemic economy. What should we know to trade these events?

The central bank had announced in September it would be buying fewer bonds off the back of surging consumer prices. For now, ECB decided to keep interest rates and its monetary policy unchanged despite ongoing inflationary pressures. Inflation in the eurozone hit 3.4% in September, representing a 13-year high.

Some market participants believe the ECB is underestimating current inflationary pressures and will therefore likely have to announce a rate hike before the start of 2023. But Lagarde said that the rates won’t be hiked anytime soon and that their anticipation and their analysis on the economic situation is correct.

Moreover, if to speak about the US, rate hikes may come in the States way earlier. Inflation in the country has already hit 5.4% and doesn’t plan to stop. If so, USD may rise significantly against EUR.

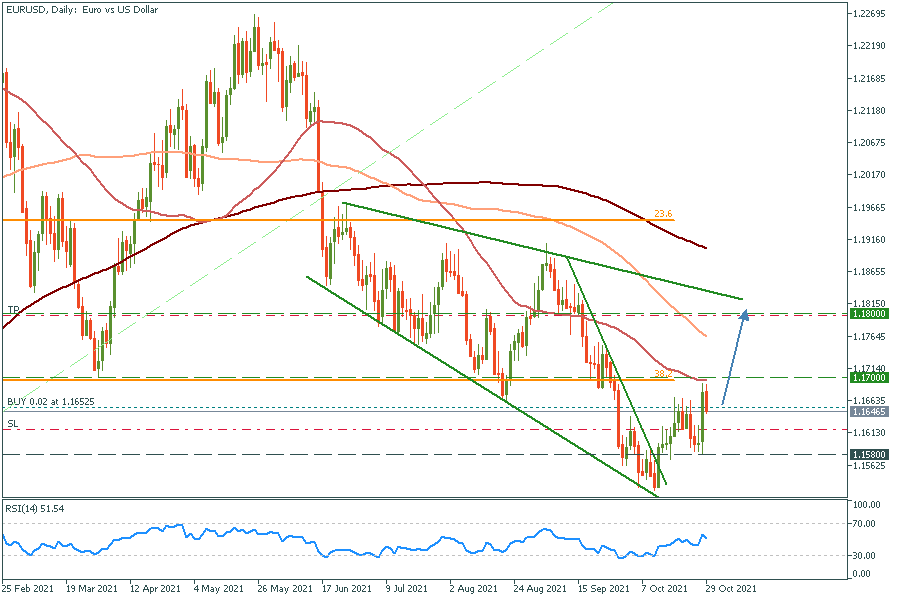

The currency is in a precarious position. Although the falling wedge had been broken, which is quite bullish, lots of moving averages are ahead and the fundamentals are multidirectional. Nevertheless, if the EUR/USD pair overcomes the resistance at 1.17, then 1,18 will be the next stop.

EUR/USD daily chart

Resistance: 1.170; 1.180

Support: 1.158; 1.150

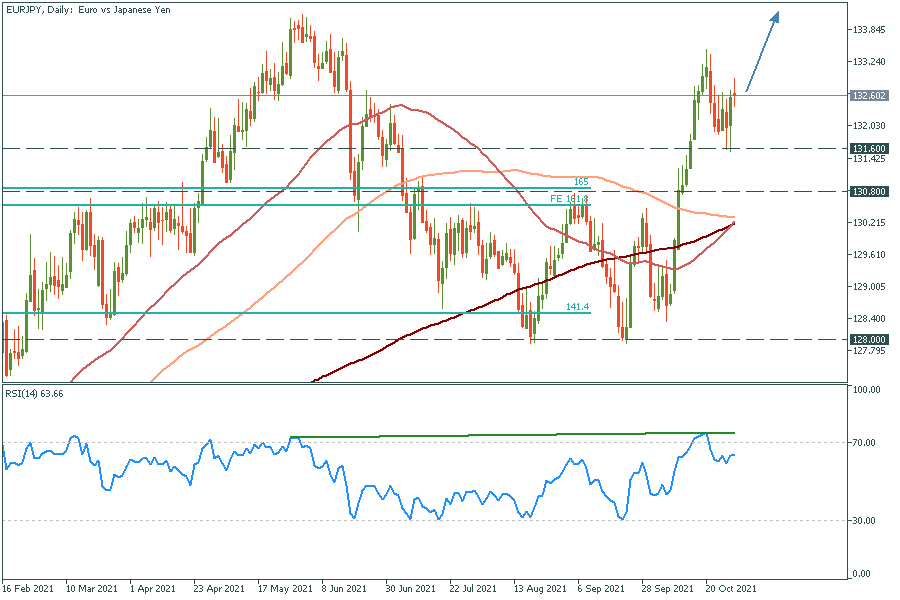

For the EUR/JPY pair, the figure is similar. While yen is weak amid QE continuation, euro may surge higher to the resistance at 134.4. But be aware of possible divergences on the RSI oscillator, they can help you to spot the upcoming reversal.

EUR/JPY daily chart

Resistance: 134.4; 135.0; 142.0

Support: 131.6; 130.8; 128.0; 127.0

Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

Pengaruh dolar sebagai matawang rizab dunia telah merosot secara beransur-ansur. Adakah mungkin untuk euro menggantikannya? Kami juga tidak pasti tentang perkara itu.

Fundamental : …

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!