Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

2019-11-11 • Dikemaskini

The upcoming days are going to contain lots of important economic events. Let’s go through them together in order to prepare for profitable trading.

When: Wednesday, June 26

Instruments to trade: NZD/USD, NZD/JPY, AUD/NZD

According to the consensus forecast, the Reserve Bank of New Zealand will leave its benchmark interest rate unchanged at 1.5% after the central bank cut it in May.

All in all, we can’t expect much optimism from the RBNZ. After all, New Zealand’s economic growth staggered at 5-year low in Q1. Still, according to swaps, the market is already pricing in 42 basis points of additional rate cuts this year. As a result, even if the regulator is dovish, the potential for further weakness in the NZD is limited. On the contrary, if the RBNZ sounds less dovish, the currency will be able to strengthen in the short term.

When: Friday, June 28 - Saturday, June 29

Instruments to trade: USD/CNH, USD/JPY, USD/TRY

The United States and China agreed to meet at the G20 summit. That gave traders hope that the two nations will be able to make some progress in their trade talks and avert the mutual tariffs that are creating risks for the global economy.

In addition, the meeting between Donald Trump and Turkish President Tayyip Erdogan will have a big impact on the Turkish lira. The parties will discuss Turkey’s purchase of Russian S-400 defense systems and the threat of US sanctions.

When: Monday, July 1 - Tuesday, July 2

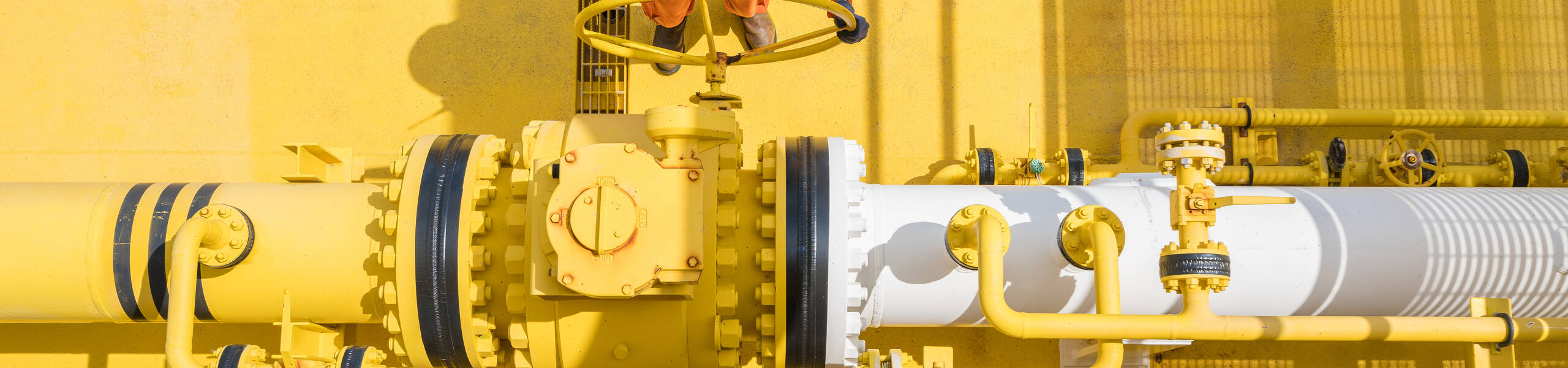

Instruments to trade: WTI, Brent

The Organization of Petroleum Exporting Countries (OPEC) was to meet on June 25-26. However, the separate OPEC ministerial meeting and the meeting of OPEC and its allies, known as OPEC+, were postponed to July 1-2. The reason for the delay is that Saudi Arabia, Iran, and non-OPEC Russia want to see the results of the G20 meeting.

The world’s leading crude oil producers will have to decide on whether to continue the deal to reduce production by 1.2 million barrels a day (the deal runs out on June 30). The most likely scenario is that that production cuts will be extended. This will have a minor impact on the oil price. However, other outcomes are also possible. If the cuts aren’t extended, the oil will tumble - this will, however, be possible only if the US and China reach a trade deal before the OPEC meeting. On the contrary, bigger cuts will make oil soar.

Notice that oil climbed in the past week due to the growing tensions in the Middle East. Iran shot down an American drone and almost triggered US airstrikes. The US also blames Iran for attacks on two tankers near the Strait of Hormuz. The escalation of the situation is a threat to oil supply and thus positive for the price.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Pada hari Khamis, 2 Jun, Pertubuhan Negara-Negara Pengeksport Petroleum Plus (OPEC+) telah bersetuju untuk meningkatkan pengeluaran sebanyak 648,000 tong sehari (bpd) pada bulan Julai dan Ogos.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!