Powell mahukan pendaratan yang lembut untuk inflasi, seperti yang dilakukan oleh Greenspan pada tahun 1994. Tetapi nampaknya dia akan menempuh satu pendaratan yang sukar.

2020-10-22 • Dikemaskini

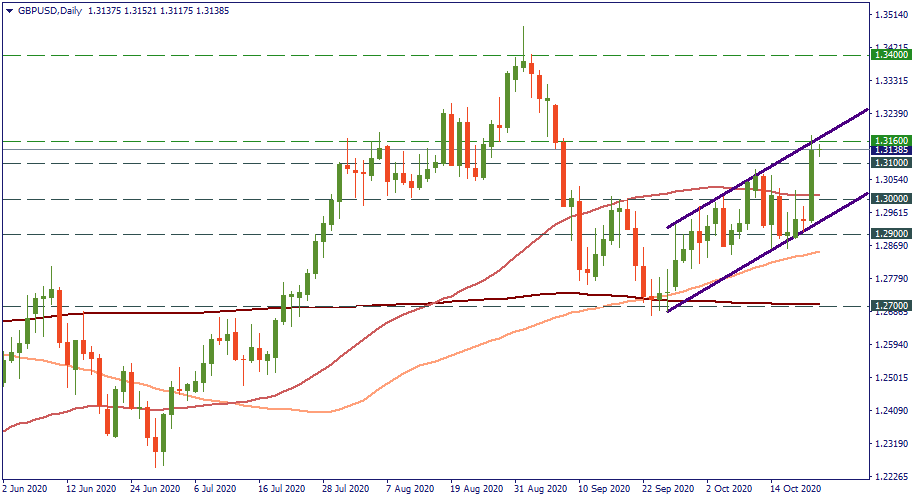

Brexit is stalled, but both the EU and the UK express hopes for a successful resolution. These hopes recently sparked an aggressive spike the GBP went on against the EUR and the USD. What’s the technical outlook?

As surprising as it may sound, those strong moves don’t introduce any change into the existing trends. On a daily chart below, the last large green candlestick is exactly the rise of GBP/USD on Wednesday. The move was really big and doesn’t even have a similar one in magnitude on this panorama. But tactically, it falls well into the uptrend that has been in the place since the middle of September. From below 1.30, GBP/USD rose above 1.31. Most probably, it will go into bearish correction above 1.30 to eventually reverse and rise back above 1.31 on the other side of the uptrend.

Pretty much the same applies to EUR/GBP. After hanging above 0.9040, it plunged down to almost 0.9000. Tactically, that’s just another wave in in a local downtrend that has been in the place since the middle of September. A large one though – you can see that last long red candlestick between 0.9150 and 0.9000. Strategically, that downtrend itself is just another wave in a larger gradual uptrend that’s visible all across the chart. So the observers are right to say that Brexit is merely a local episode for the UK economy – the fundamental factors is what matters.

Powell mahukan pendaratan yang lembut untuk inflasi, seperti yang dilakukan oleh Greenspan pada tahun 1994. Tetapi nampaknya dia akan menempuh satu pendaratan yang sukar.

Saham apakah yang akan paling awal sekali menerbitkan laporan suku tahunannya? Jom kita tinjau dan bersiap sedia untuk saksikan gerakan di pasaran saham!

Tahun 2020 akhirnya melabuhkan tirainya. Akhirnya. Mari kita lihat apa yang berlaku di pasaran Forex sepanjang tahun berkenaan dan cuba mencari tahu apa yang mungkin berlaku pada tahun berikutnya.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!