Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

2020-06-04 • Dikemaskini

The stock market takes a breath after the rally up for almost two weeks. What is the forecast?

According to Goldman analysts, stocks won’t keep moving up and “unloved but welcome” S&P 500 growth may stop soon. They anticipate that the price may go as low as 2,750 and as high as 3,200.

The market sentiment improved as investors have optimistic outlook for economies reopening and eased lockdowns. In addition, the US ADP report showed that only 3 million people lost jobs in May when economists expected at least 9 million. Also, rates of new coronavirus cases significantly decreased. Moreover, unprecedented amount of aid packages and reduced interest rates from central banks across the world underpinned investors and boosted their risk appetite.

Any barriers in the way to the full recovery or political risks may send it down. We remember how long US-China tensions were deteriorating the market sentiment. Also, let’s look a bit inside the S&P 500 composition as analysts believe it’s better to trade single stocks than indexes. The five largest S&P 500 companies: Alphabet, Apple, Amazon, Facebook and Microsoft have gained 15% so far in 2020, while the remaining 495 companies have fallen 8%. As a result, other S&P 500 companies should join the top 5 to allow the stock index to rise further.

Goldman Sachs chief strategist, David Kostin, has set a year-end S&P 500 target of 3,000. On the one hand, certain companies can benefit from a positive outlook for a soon recovery, eased restrictions and the COVID-19 vaccine. On the other hand, there are several factors that can lead stocks down such as worsened US-China tensions or a resurgence in infection rates as countries reopen.

Technical outlook

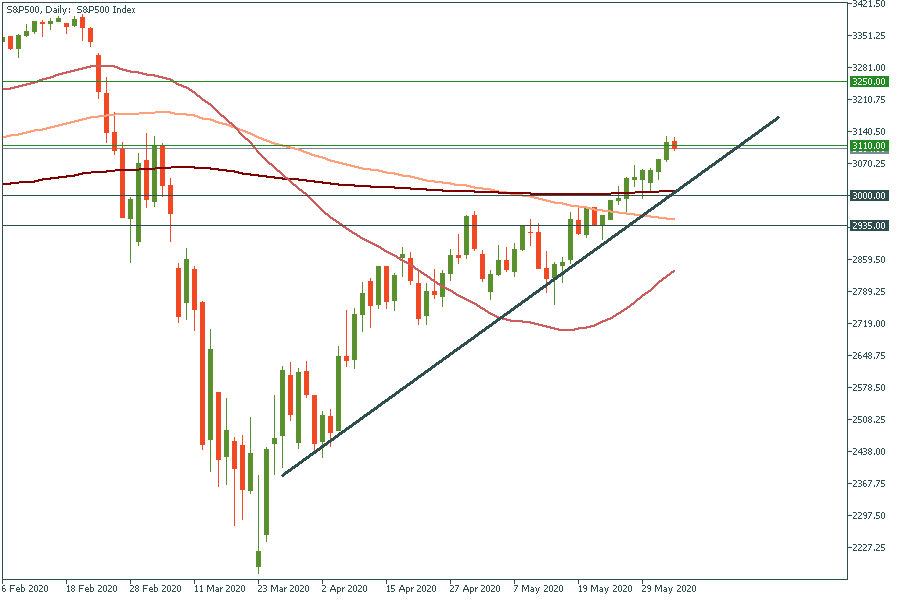

S&P 500 set a strong upward trend. It has been climbing up since March 20. Now the stock index is trading really high. It’s above all moving averages. If it crosses the resistance level at 3110, it will go further to the next one at 3250. Support levels are 3000 and 2935.

Read these articles to know more about stocks: "Trade the most famous stock indexes" and "How to trade stocks with FBS?"

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Tampaknya drama di antara para pengguna Reddit dan firma-firma dana lindung nilai Wall Street telah mereda sejak awal minggu ini.

Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!