Coinbase (#COIN) menyaksikan hasilnya meningkat kepada $773 juta pada Q1 2024, peningkatan 23% daripada suku sebelumnya dan melepasi jangkaan penganalisis.

2020-05-21 • Dikemaskini

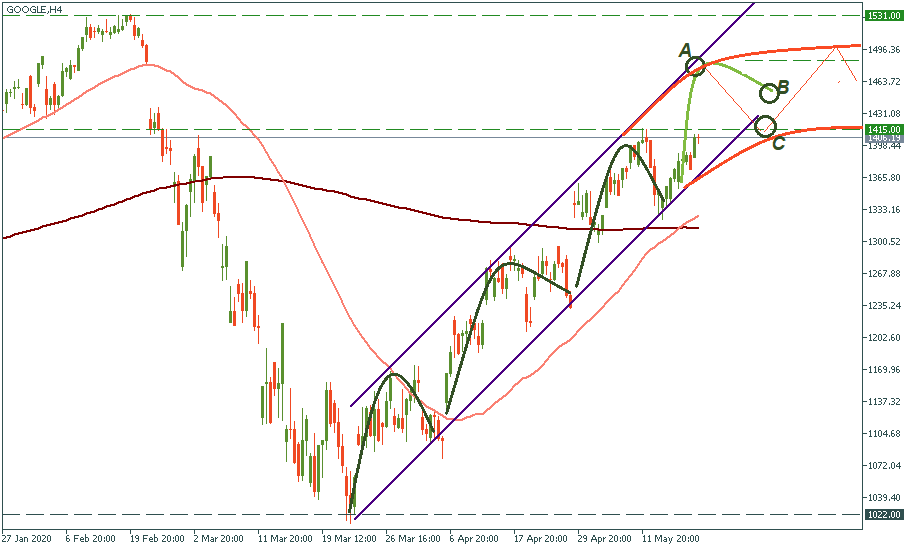

On the H4 chart, we see Google stock on the path of recovery. It is almost there, but the question is whether the pace of recovery will remain the same, completing the V-like overall chart formation, or it will slow down coming closer to the resistance of $1,531. Let’s see how we can find that out.

In the case of steady growth consistent with the trajectory it has been showing after bottoming out in March, the price will make another leap to the higher boundary of the movement channel, which will come to point A roughly corresponding to $1,490. After that, if the inner logic of the movement remains, the price will bounce down to point B – that’s where the lower boundary of the channel will be. This will complete the fourth wave of the upward movement.

Otherwise, the stock will slow down the closer it gets to the full recovery mark of $1,531. In the weakening growth scenario, the stock may come to point A or slip lower to eventually get into a bearish move crossing the lower border of the initial movement channel. That’s how point C may be reached, bending the overall trajectory range closer to the horizon. After that, the stock will anyway rise again, but probably to $1,496 or even below.

Which scenario will it be? Make your bets, we will discover soon enough.

Coinbase (#COIN) menyaksikan hasilnya meningkat kepada $773 juta pada Q1 2024, peningkatan 23% daripada suku sebelumnya dan melepasi jangkaan penganalisis.

Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

Powell mahukan pendaratan yang lembut untuk inflasi, seperti yang dilakukan oleh Greenspan pada tahun 1994. Tetapi nampaknya dia akan menempuh satu pendaratan yang sukar.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!