Gas asli adalah tiang seri ekonomi Eropah.

2022-12-15 • Dikemaskini

The Russian president's announcement that countries "unfriendly" to Moscow must pay for gas deliveries with rubles shows that he's willing to use energy as a weapon in the Ukraine war. It puts the West in a tight spot.

With his demand for payments in the Russian currency, Vladimir Putin has dealt a surprise blow to Western countries still using large volumes of Russian gas for their energy needs.

The Russian president stated the measure would apply to 48 countries deemed "hostile" and include the United States, the UK, and all members of the European Union.

Combined with an extremely growing inflation in Europe, this fact might press the euro to the lowest numbers since 2015.

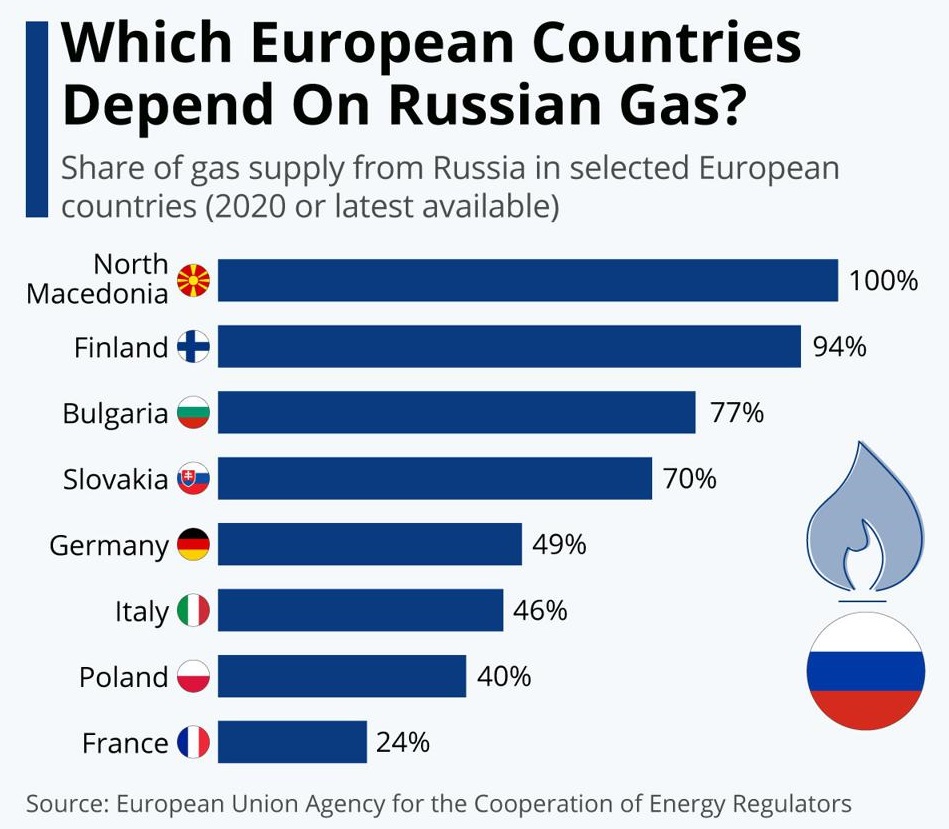

Europe is the number one continent depending on the Russian gas supply. Data from the European Union Agency for the Cooperation of Energy Regulators shows which countries' energy supply would be most in jeopardy in the case of a Russian gas freeze.

Among the continent's major economies Germany imports around half of its gas from Russia, while France only obtains a quarter of its overall supply. Italy would also be one of the most impacted major economies at a 46% reliance.

Some smaller countries in Europe rely exclusively on Russian gas, namely North Macedonia, Bosnia and Herzegovina, and Moldova. Dependence also exceeded 90% of the gas supply in Finland and Latvia.

As we can see, Russian holds the most significant part of the European gas market. That's why the European Union needs to find the right decision in this situation.

There are three possible outcomes:

US president Joe Biden called the European Union to refuse the Russian gas and replace it with US LNG (liquid natural gas). However, there are some issues with it.

Based on all of the above, unfortunately, Europe has little chance to avoid an energy crisis so far. Rising inflation adds oil to flames. It’s necessary to tighten the monetary policy and reduce the balance sheet in the future. Nowadays, people are going on strike with the topic of rising prices for raw materials, fuel, and fertilizers. However, Gazprom is 100% fulfilling all its obligations under the contracts. What will happen if Gazprom turns off the pipeline for at least a month? A shutdown of factories, unemployment, the introduction of food cards may happen. Alternatively, the European Central Bank will have to print money and increase inflation to 20%-40%.

EURUSD, monthly chart

Why do we love technical analysis? Because at moments of total uncertainty, it may tell us the only right way.

EURUSD is moving in the symmetrical triangle. At the moment, the price is consolidating above the lower border. The most important support level right now is 1.0800. If buyers manage to hold the pair above it, the price might reverse and increase to 1.1150 and even 1.1450.

On the other hand, a breakout of this support will signal a long bear market for EURUSD, and the pair will decline to 1.0500.

Gas asli adalah tiang seri ekonomi Eropah.

Ya, harga minyak sedang terbakar menyala-nyala sekarang, dan, akibatnya, inflasi semakin memanas di seluruh dunia. Namun begitu, momentum kenaikan harga minyak sedang terancam.

Awan hitam berarak di langit pasaran tenaga dan minyak lantaran dari ketegangan geopolitik, dengan meningkatnya kebimbangan mengenai potensi Ukraine diceroboh oleh Rusia.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!