Is the AUD set to fall?

2022-11-23 • Dikemaskini

It seems like better days have passed for the Australian dollar. On October 15, the Reserve Bank of Australia’s Governor Philip Lowe signaled more stimulus measures at the next meeting on November 3. The Australian dollar was triggered by his remarks and immediately dropped below the 0.71 level. In this article, we are looking closer at the highlights of the upcoming meeting and see the forecasts for the AUD.

Doves are coming

We recommend you to mark November 3 in your calendars, as the market is going to be very volatile. Firstly, we have the RBA meeting, then the election in the US. You still have two weeks to learn more about these events for successful trading. So, what do we need to expect from the RBA meeting? Here are the main insights by the RBA Governor.

- According to the comments by the RBA Governor, the Bank will cut the interest rate closer to zero in November (i.e. from 0.25% to 0.1%)

- The regulator will buy long-term federal and state government bonds to pull the AUD down and support employment.

- The current goal of the regulator in the current realities caused by Covid-19 – to make the unemployment rate lower.

- Australia has one of the highest 10-year bond yields among other countries. So, according to Mr. Lowe, buying the bonds will help to stimulate exports, support local businesses, and, therefore, boost the demand for domestic goods.

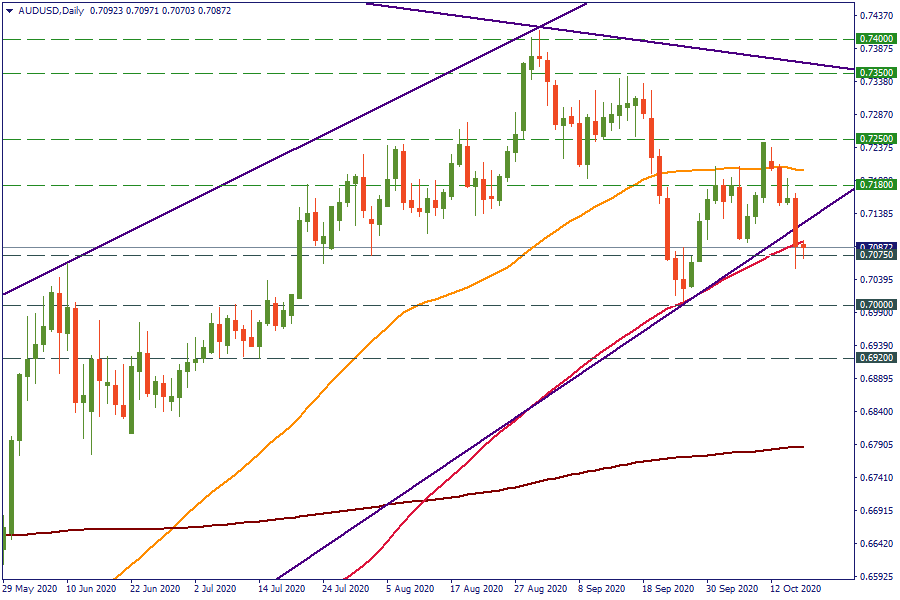

Following these comments, the Australian dollar weakened significantly against other currencies. On the chart below, we can see that AUD/USD broke below the ascending trendline and tested the lows below 0.7075. However, the support at 0.7075 (100-day SMA) appeared to be pretty strong to hold the gears of sellers for now. A drop below this level will pull the pair lower to 0.7. On the upside, a sudden strength of the AUD may provoke the rise to the resistance at 0.7180

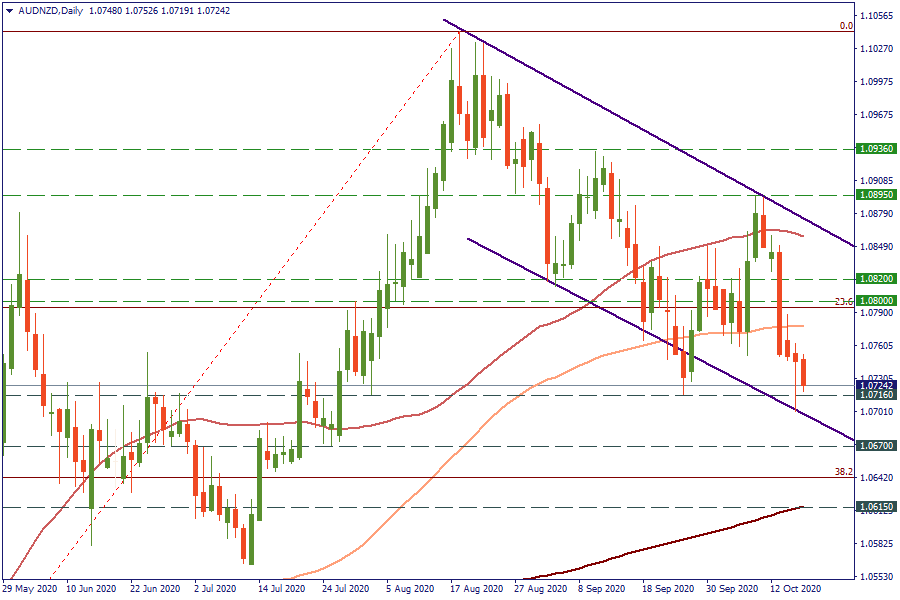

The Australian dollar got weaker even against its antipodean colleague – the New Zealand dollar. On the daily chart, AUD/NZD has been trading within the descending channel. The pair fell below the 100-day SMA this week and tested the 1.0716 level. The next target lies at 1.0670. On the upside, the resistance level is placed at 1.0800.

What are the forecasts?

Despite a quite dovish note, not all major analytical banks are sure about a significant fall of the AUD. For example, analysts from ANZ Bank claim that AUD/USD will remain at 0.7 for the medium term. At the same time, reaching the 0.73 target by the end of 2020 is put at risk, according to them. Analysts from Commerzbank are not so optimistic, as they see AUD/USD falling to 0.6964 and even lower, to the mid-June level at 0.6789. At the same time, analysts from UOB Group don’t expect the pair to cross the 0.7 level.

In our opinion, the dovish tone of the RBA will put the aussie under pressure right until the next meeting on November 3. After the release of the monetary policy statement, the famous “buy the rumor, sell the fact” theory may come into action, and the AUD may correct to the upside, before moving lower.

Serupa

Pasangan AUDUSD terus menolak tahap 0…

Berita terkini

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…