Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

2020-02-04 • Dikemaskini

“2020 looks like it has upside potential that will also defy some of the gloomy predictions” – these were the words of the OPEC Secretary-General Mohamed Barkindo in November. He added that time that he saw brighter spots in the nearest future for the cartel.

A month later, during the OPEC meeting on December 5, it was decided to cut the output by 500,000 bpd for the first quarter of 2020. The general impression of that meeting provided little optimism on behalf of the OPEC to the journalists. In fact, there were hardly any official comments at all.

Now, OPEC and its strategic ally Russia are considering to hold an emergency meeting to address the weak oil demand from China resulting from Coronavirus counter-measures. The original time when the cartel was planning to gather for discussion was March, then the date was moved forward to February 14. Eventually, it may be set even earlier as observers report.

To put things in context, here are some additional facts. As of February 2020, Libya has cut its oil output by approximately 80%. The price should have increased because of that, but didn’t, eventually. At the same time, the oil production has reached its new records both in Russian and USA – which means there will be more tension between the US and OPEC+ as both gain more weight but have almost opposing interests.

It says things don’t look good for the oil price. Or they do – depends on who is seeing this. For OPEC obviously it’s bad: the cartel’s member countries are oil-dependent, and the oil price heavily contributes to the county income. The lower the price is – the lower the county income is. Entire political structures and domestic economies may tremble because of this alone, and it happened already.

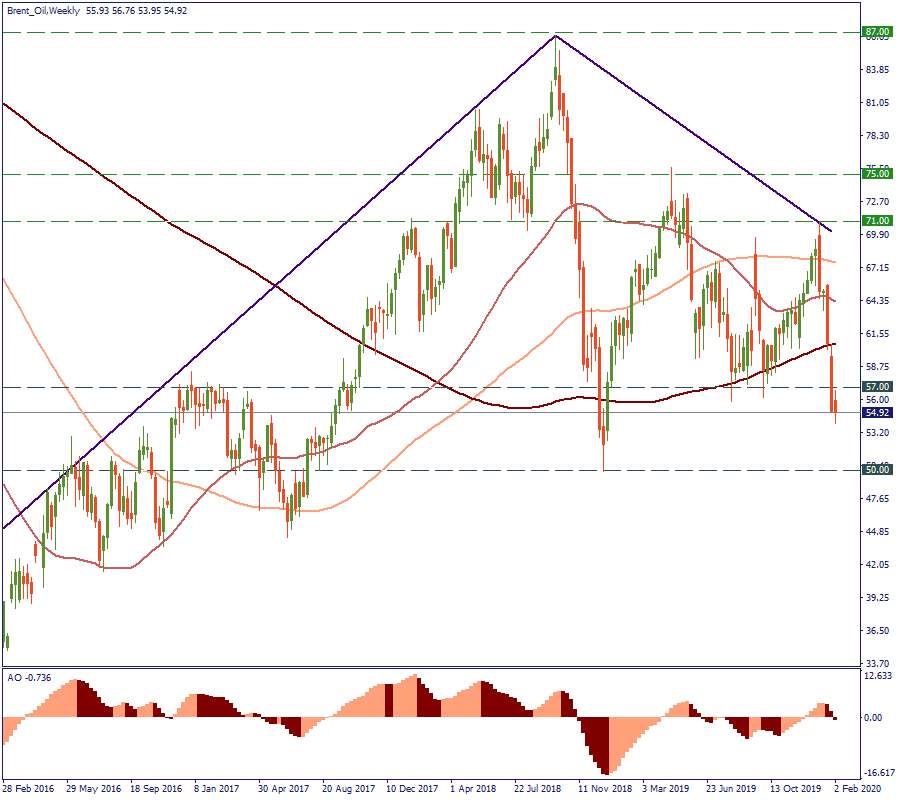

The oil price broke the level of $57 recently (for Brent) – the level that has been the support for its movement through 2019. The three-years support of $50 is not that far away – meaning it’s almost where it was before the US-China trade war. Sounds quite alarming; and it should – at least, for the countries which have oil as the main state profit contributor.

We are far from seeing stability in oil prices, so you can use it and make profit on that. In addition, trading oil is a good diversification and additional to currencies.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Pada hari Khamis, 2 Jun, Pertubuhan Negara-Negara Pengeksport Petroleum Plus (OPEC+) telah bersetuju untuk meningkatkan pengeluaran sebanyak 648,000 tong sehari (bpd) pada bulan Julai dan Ogos.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!