Gas asli adalah tiang seri ekonomi Eropah.

2021-08-27 • Dikemaskini

Institutional investors speak about further growth in the stock market. In the exact market that has doubled since COVID-19 and doesn’t plan to stop. Is it possible? What can we say about the broad market, and do we have a risk of a deep plunge? All of that plus something extra in our new article.

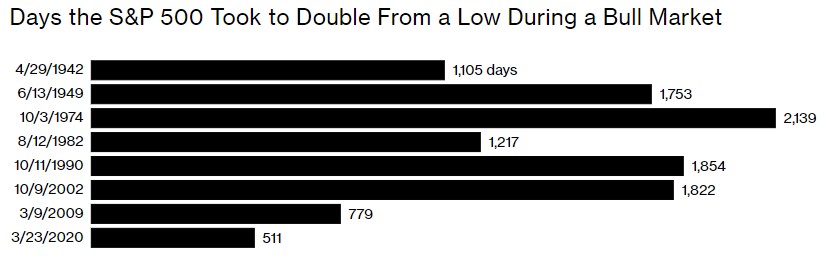

The S&P 500 has more than doubled since its pandemic lows in March 2020, although gains have recently been capped by fears the Fed could begin to taper its massive stimulus program sooner than expected. The index is up about 20% so far this year. On average the market needs more than 1000 trading sessions to gain 100% from the bottom. This time the result was achieved after mere 354 sessions, it is the fastest recovery of the S&P 500 since World War II.

Source: https://www.bloomberg.com/europe

With the second-quarter U.S. reporting season completed, final data shows that about 87% of S&P 500 companies have beaten analysts’ profit expectations, the highest on record. There are several possible reasons for such results:

If it is about the first case, all we can do is to be happy about such flexibility. But if it is about expectations, then the growth is mostly fake. Let me explain this. Expectations from the companies were low. Earnings reports exceeded them. Investors start buying stocks and their price rises, thus, the S&P 500 rises as well. The excitement of retail investors and their hopes about everlasting market growth is a dangerous sign. Extreme greed can lead to extra volatility and big losses. Learn more about the Fear & Greed index in our article to notice the time to open short positions.

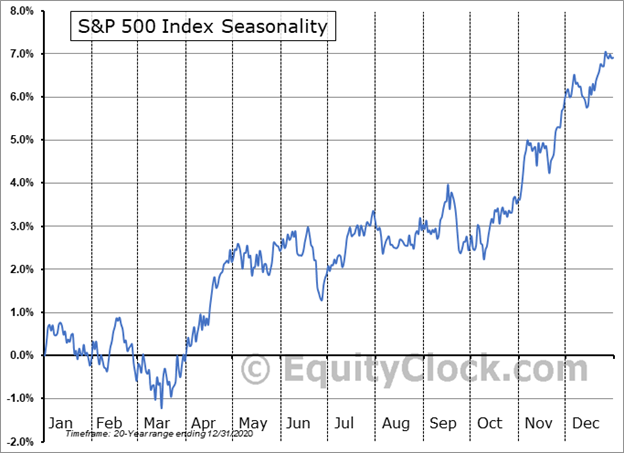

Over the last 31 years, there have been nine instances where the S&P 500 rallied 10% in the first eight months of the year followed by an average 8.4% climb over the final four months. September usually is more volatile than August. This is the so-called seasonality of the markets, and it’s time-honored!

Source: https://charts.equityclock.com/sp-500-index-seasonal-chart

First, let’s have a look at banks’ predictions of the market.

As you can see, only BoA supposes that markets will fall. Notice, that almost every massive correction in history has been accompanied by bankers and institutions’ speeches about further growth. Only six weeks before the Lehman (it was one of the oldest and biggest banks in the US), in early August 2008, both the Federal Reserve and professional forecasters predicted continued growth of the U.S. economy. Contrary to that prediction, the U.S. financial system nearly melted down after the Lehman bankruptcy, and the economy slid into a deep recession. Should we worry now?

As for the current situation, with fears growing that the worst is yet to come, hedge funds stepped up selling. During the first four days of last week (August 15-18), they dumped stocks at the fastest pace in four months, with short sales outpacing long buys by a ratio of 10-to-1. Between you and me – hedge funds know how to trade with minimal risks, they are so-called “clever money”, so if they start selling – it is a reason to reflect on markets, at the very least, and to reduce your long positions as well. Fortunately, with FBS you can open both long and short trades and earn from every movement of the market!

Nevertheless, even the most powerful and clever bears are giving up and closing their shorts. Wells Fargo’s strategists boosted S&P 500 targets, as I mentioned before. As bears give up, their moves add fuel to the rally that’s already the fastest in nine decades but don’t get fascinated with it.

The Jackson Hole Symposium has started today, and we already have a message from FOMC and St. Louis Federal Reserve President James Bullard. The Federal Open Market Committee made hawkish comments, urging the Fed to start tapering its asset purchase program. Federal Reserve Bank of Kansas City President Esther George said that policymakers should begin to slow asset purchases even though the delta variant poses a risk to the US economic outlook and job growth. Fed’s Bullard claimed that the central bank should begin curbing its monthly stimulus efforts soon and have the process wrapped up by the end of March to prevent the US economy from overheating. He added that inflation is growing faster than it was expected and could reach 2.5% by 2022.

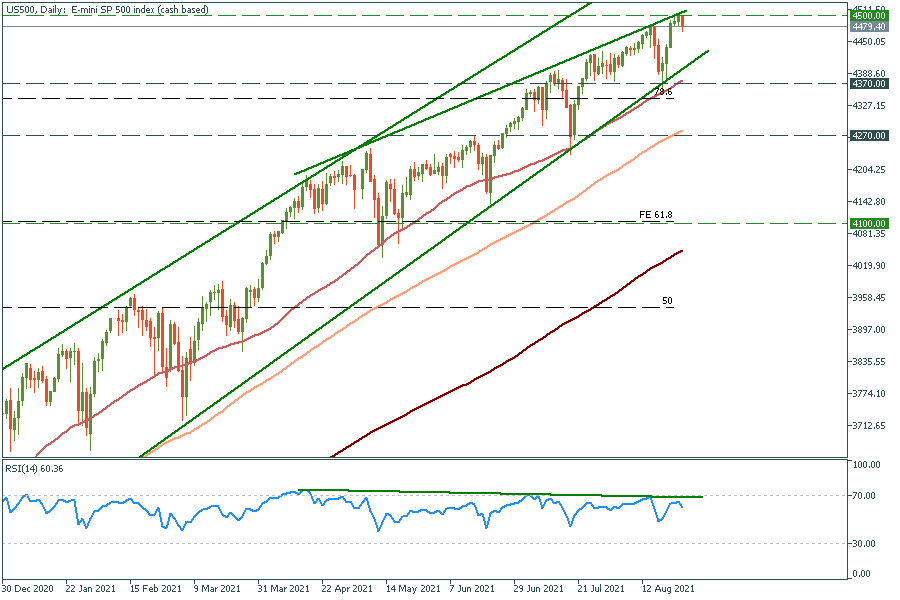

We have a divergence on the RSI oscillator. This is a considerable sign of market retracement. Price is still in a trend, but not as strong as before.

S&P 500 daily chart

Support: 4370, 4270 and 4100

Resistance: 4500 and 4600

Now we have much more bearish signs. Frankly speaking, I would consider selling US 500. Market crashes are rare but can make you a ton of money. Be aware though, that it is a risky countertrend move, always set stop losses and calculate your risks with our trader’s calculator.

Gas asli adalah tiang seri ekonomi Eropah.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!