Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

2020-04-06 • Dikemaskini

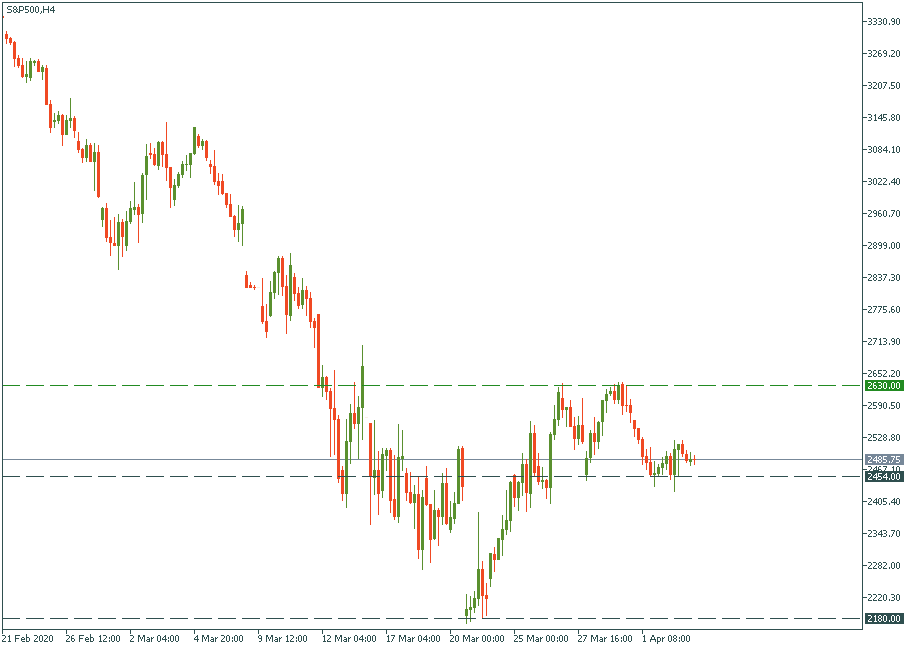

Probably, the main question most observers have now with respect to the stock market and S&P 500, in particular, is whether there will be another bottom or not. Fundamentals don’t give a simple answer.

On the one hand, the very fact that the market did not continue the plunge after March 20 but showed an almost instantaneous recovery from 2,180 to 2,630 is a good sign. It may be well interpreted that never before the US market has been as strong as now – fundamentally. Let’s remember the end of the year, January and Donald Trump’s speech in Davos: American economy was reporting multiyear expansion, record employment rates, worldwide loyalty to the USD, and the US as the economic, political and military centre of gravity. All of that couldn’t have been reached without the underlying healthy performance of the companies that comprise the S&P. In addition to that, the two-year discord over tariffs with China was over, and the path to the bright future was finally eyed. Therefore, in general, the US economy was delivering outstanding results in a world which (seemingly) found it’s general frame for prosperity.

An obvious strike at optimists camp is the unprecedented damage and the cross-continent scale of the virus infection which quickly grew from being an almost exclusively Chinese problem to the global pandemic. To the very last moment, the global community was reluctant to believe that borders will have to be closed, flights canceled, cities locked down, populations quarantined, and outdoor performance camps to be converted into hospitals. Once it did, the index went straight into the plunge.

The picture was significantly aggravated by an untimely dispute between Russia and Saudi Arabia over oil supply quantities, which the US refused to help to sort out on the spot. Now, with approximately 30% of global oil oversupply, petroleum tanks sitting full, and the price of oil pushing states to close the wells, observers comment that the moment to solve the matter may be lost. Aggravated by this, what previously looked like a possibility of a recession more often appears like a full-scale depression.

And lastly, the US never saw 6.5mln people applying for unemployment social benefits. Pretty ironically, the damage to the labor market in the US was as unseen as its strong indicators were right before the virus hit.

Last Thursday, Donald Trump urged Russia and Saudi Arabia to sit at the negotiations table. This week, a remote OPEC+ meeting is supposed to take place (hopefully). Although observers are pretty skeptical about the outcomes, the initiative itself and the confident manner with which Donald Trump was announcing that to the journalists are still somewhat reassuring.

Also, Spain and Italy seem to be seeing the levels of infections leveling out, with the US itself nearing the peak of the virus within the coming two weeks. China is already back to recovery.

Therefore, the general picture is no longer that universally dark as it was, say, a month ago. There are brighter spots in the outlook, and the S&P’s recovery seems not that far away. Very likely, the investors have already priced in the worst of the damage and are now looking for lighter scenarios.

Therefore, let’s keep the spirits uplifted, but the mind cold and observant: the trade decisions should not be affected neither by hope nor my desperation. Rather, by calculation. Next week will show us where the situation leads.

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Tampaknya drama di antara para pengguna Reddit dan firma-firma dana lindung nilai Wall Street telah mereda sejak awal minggu ini.

Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!