Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

2019-11-11 • Dikemaskini

The new earnings season has started in the United States. This means stocks of the largest American companies will likely make big moves. You can trade these stocks with FBS (learn more) and make money!

Tuesday, July 16

EPS forecast: $2.51

Revenue forecast: $28.84B

The stock of JPMorgan (JPM) has been on the rise since the end of May. Its dynamics was in line with the good performance of the financial sector in general during the past month. JPM advanced even despite the expectations that the Federal Reserve will cut interest rates - such a move is negative for banks as it will become more difficult for them to make money on loans. In addition, the US-China trade war and worries of an economic slowdown also create substantial risks.

Yet, JPMorgan has successfully passed the Fed’s ‘stress test’ at the end of June. It means that the bank’s position is safe and sound. It also encouraged buybacks of JPM stocks thus increasing the demand for it and pushing the rice higher.

As a result, traders and investor will look at the upcoming earnings report to see whether it provides the stock with yet another driver to overcome the resistance it has reached. The nearest obstacle on the upside is located in the area of 116.90 (resistance line connecting 2018 and 2019 highs). The maximums themselves form resistance in the 119.00 zone. Support is located in the 110.85/00 zone.

Wednesday, July 17

EPS forecast: $0.71

Revenue forecast: $23.12B

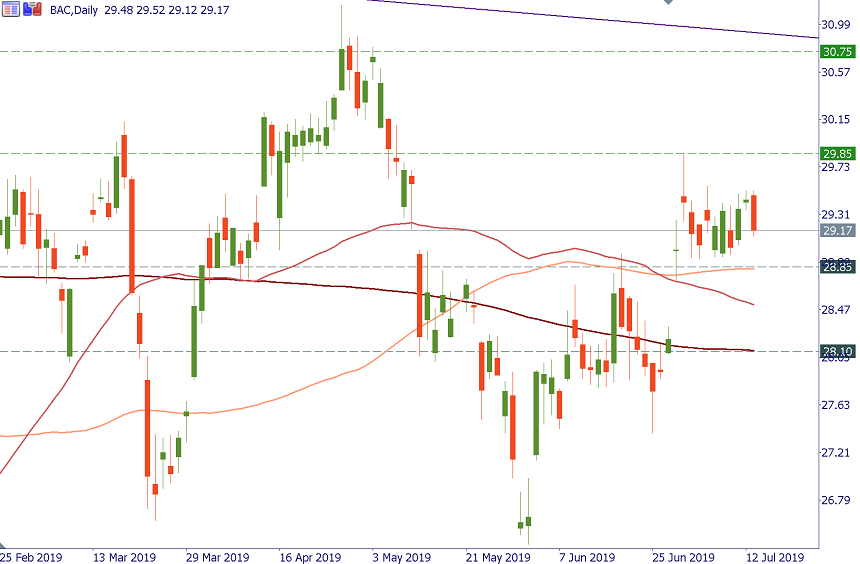

Like JPMorgan, Bank of America is another key US financial institution that is considered to be “too big to fail” by the nation’s government.

The bank has earlier expressed intention to cut cost, so investors will scan its earnings report for information whether it was able to hold to this plan. Notice that BAC’s EPS have managed to beat estimates during 12 quarters in a row. Although this time the figures may be affected by tough conditions in securities trading, consumer lending has likely remained solid, so the overall result should be OK.

Technically, the stock has been trading sideways this year. An advance above 29.85 will bring it to 30.75 (resistance from 2018 highs). Support is at 28.85 (100-day MA) and 28.10 (200-day MA).

EPS forecast: $3.08

Revenue forecast: $19.18B

The upcoming earnings report will be important for IBM for several reasons. First of all, its $34-billion acquisition of the software company Red Hat has been recently finalized and may be reflected in the figures. Secondly, IBM’s result may get the positive impact of its partnership with Vodafone in the area of artificial intelligence (AI) technology. Finally, the company has done some restructuring to focus on IT. Note that IBM will host an investor briefing on Aug. 2 — there will be more important information that has an impact on its stock then.

IBM stock has been on the upside since the start of the summer. It managed to overcome the resistance line from the 2018 highs in the 140.00 area. Now, this level acts as support together with 138.00. The further upside target is at 145.40 (April high) and 147.90 (38.2% Fibo of the 2013-2018 decline).

EPS forecast: $0.56

Revenue forecast: $4.93B

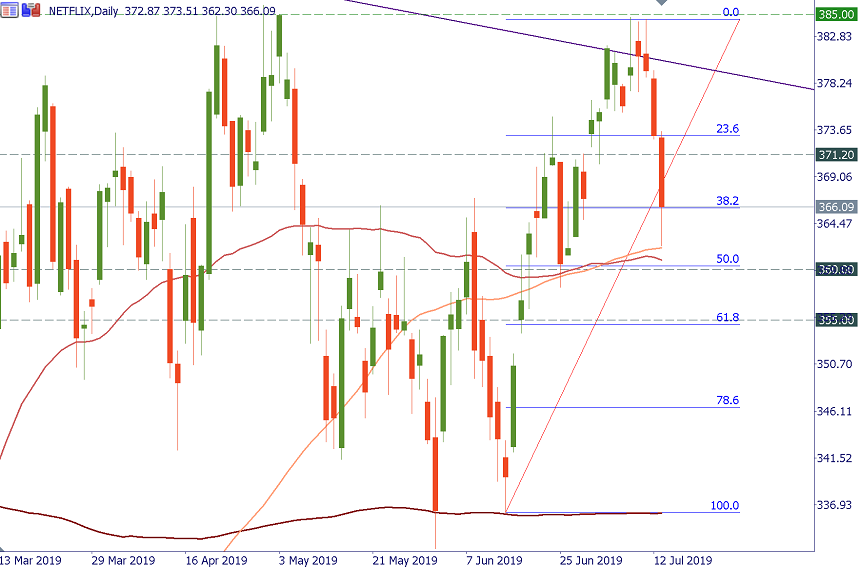

Analysts expect the streaming-TV giant to report solid results for the past quarter. According to the forecasts, the company will show impressive subscriber growth — the stock usually strongly reacts to this indicator, as well as to average revenue per user. The fact that Netflix increased prices in North America not so long ago will likely boost its revenue. The consensus forecast is that we will see a 26% y/y increase in revenue.

However, not everything is that rosy. Netflix has to spend more and more on content. As a result, the company’s operating margin has narrowed and its free cash flow worsened. An effective tax rate is expected to hurt EPS. Finally, remember that the year is going to be very challenging for Netflix as Disney launches its own streaming service, while such hits as The Office and Friends will be pulled from it by NBCUniversal and WarnerMedia.

This month, Netflix stock met resistance line going from the 2018 highs and failed to overcome the 385.00 level. A bearish candlestick with a long upper wick was formed on W1. However, the price got the support of the daily moving averages in the 362.00 area. The next support levels are at $360 and $355.

EPS forecast: $0.62

Revenue forecast: $2.68B

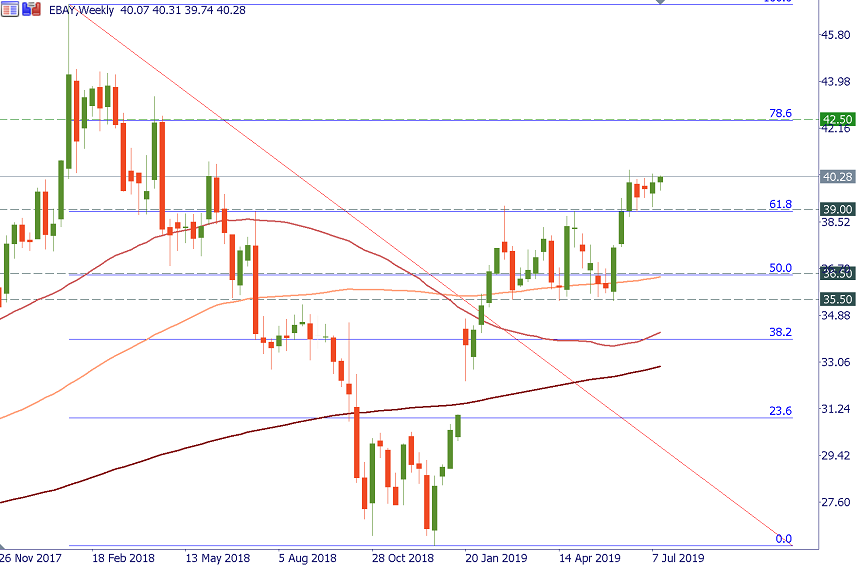

The stock of eBay has been in the uptrend since the start of 2019. The stock has managed to break above after consolidating in the 35.50/39.00 range. This adds credibility to the uptrend. The next bullish target lies at 42.50 (78.6% Fibo of the 2018 decline). Support is at 39.00.

The current environment seems beneficial for eBay: the company’s benefitting from the general success of the e-commerce industry and its asset-light operating model that converts growth into money really fast.

The fact that the market has been quite optimistic about eBay means that its financial results should be better-than-expected for the price to keep pushing higher in the near term. If the readings are in line or worse than forecast, we’ll see a correction to the downside. Apart from EPS and revenue, watch such indicators as the growth of active buyers and sales volume.

Thursday, July 18

EPS forecast: $1.21

Revenue forecast: $32.75B

The stock of Microsoft is in the long-term uptrend and constantly renewing the record high helping the firm to achieve trillion-dollar market capitalization. Resistance can be now placed at 140.00, while support is at 138.00 and 135.00. On average, analysts think that the price will head towards 146.00.

The main factor which will contribute to the company’s financial results in a positive way is the growth in Microsoft’s cloud computing service — Azure. In the previously reported quarter, the revenue of this business jumped by 75% y/y at constant currency.

The key question is whether Microsoft is able to sustain its fast growth pace. If so, the price will continue setting new highs. If there’s a slowdown, the stock may experience a more pronounced correction.

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Tampaknya drama di antara para pengguna Reddit dan firma-firma dana lindung nilai Wall Street telah mereda sejak awal minggu ini.

Laporan perolehan akan menunjukkan prestasi syarikat pada suku tahun ketiga.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!