Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

2019-11-11 • Dikemaskini

The earnings season is in a full swing in America. Every day the largest US companies are releasing their financial statements. This leads to big moves of stock prices. You can now trade these stocks with FBS (learn more).

During the upcoming days there will be several earnings reports we would like to focus on:

Jan 18 - Netflix

Jan 22 - IBM

Jan 23 - Ford Motor

Jan 24 - Intel

Below you will find the forecasts for these companies’ earnings accompanied by the fundamental and technical analysis for the stocks.

Netflix

EPS forecast: $0.25

Revenue forecast: $4.21B

The company will release its earnings report at 02:00 a.m. MT time on January 18.

Notice that as Netflix is a subscription service for watching TV episodes and movies, the number of its subscribers will another important indicator to watch apart from EPS and revenue. Usually, subscriber figures for Q4 tend to be good.

Moreover, pay attention to the company’s guidance for Q1. Netflix has recently increased prices for the United States, so traders will want to see how the company estimates the potential impact of this step. Prices were increased as Netflix has a lot of debt and craves cash. Investors will also want to know what are the spending plans on content, marketing, and development; how Netflix plans to conquer the Asian market; how the company is going to deal with the negative impact of the strong USD.

The stock is trading at the highest price since October. That month the company released a good report and outlined solid prospects. Now the price returned to the levels of that time.

The majority of analysts have positive expectations, although the stock looks a bit overbought. There’s a gap on D1 and 200-day MA at 339.40 as support. Resistance is at 378.00.

IBM

EPS forecast: $4.85

Revenue forecast: $21.8B

International Business Machines had a difficult period behind: its year-over-year revenue has been declining for 22 quarters in a row. Then there was a gleam of hope: 3 better quarters. However, the improvement was mainly due to the favorable exchange rate and the active refresh cycle for IBM machines. The impact of these positive factors will likely diminish.

The forecasts listed above represent the expectations of worse results than those of the previous quarter. Investors will want the company to reassure the market that its revenue will soon start rising.

The stock has started 2019 with a recovery, although it's still far below last year's highs. Resistance is at 124.20 and 129.30. The nearest support lies at 119.25.

Ford Motor

EPS forecast: $0.33

Revenue forecast: $38.72B

The company is trying to prepare the market for a negative outcome. It admitted on Wednesday that its Q4 earnings will likely be lower than expected by Wall Street. According to Ford, EPS will be around $0.30. At the same time, the company sounded optimistic about its prospects in 2019.

Nevertheless, it’s necessary to take into account the global economic growth slowdown and trade wars between the United States and China: these things make the automobile suffer, so despite the optimism, the year is going to be rather challenging for Ford.

The stock is in a downtrend. Support lies at 8.05 and 7.50.

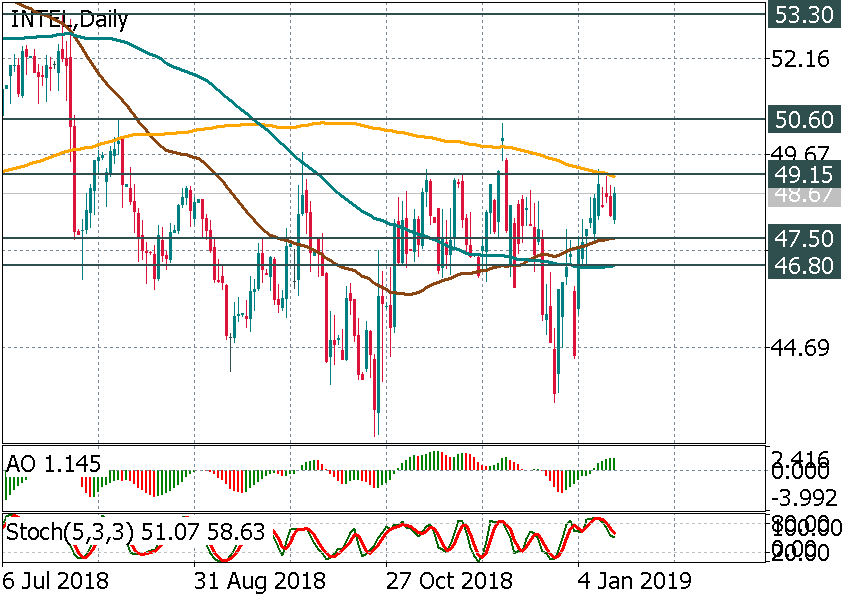

Intel

EPS forecast: $1.22

Revenue forecast: $19.02B

Intel has managed to achieve strong results in Q3. The company works at the markets which are growing fast and have a big potential (self-driving cars, cloud computing, the Internet of Things, artificial intelligence). The range of products is wide and this makes less intimidated by trade tensions. In November, the company announced that it will increase its stock repurchase program — a sign that it’s quite confident in its own future. All in all, Intel seems to be a good pick.

The stock remains far below the 52-week high (57.66). A rise above 49.15 will open the way to 50.60 and 53.30.

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Tampaknya drama di antara para pengguna Reddit dan firma-firma dana lindung nilai Wall Street telah mereda sejak awal minggu ini.

Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!