Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

2020-04-20 • Dikemaskini

As we have announced previously, the earnings reports season has started. The next two weeks will be full of releases and webcasts on corporate performance in the first quarter of 2020. Some of the companies have already reported their results. Knowing in advance that those reports cannot be “good”, let’s see how those financials affected the price of their respective shares. Based on that, we will be able to anticipate the most probable reaction of other stocks to their reports.

JPMorgan reported its results on April 14. Its EPS for the first quarter of 2020 was $0.78, which is a 70% decline year-over-year against the previous mark. Compared to the EPS of 2019’Q4 which was $2.57, the drop was also 70%. The 12-month EPS was $8.85, a decline of 4.6% year-over-year.

Overall, the presented results were pretty far away from the market expectations. For example, the consensus for the quarterly EPS was $1.7 - almost $1 higher than the released figure. Anticipating a strong hit at the general 2020 performance because of this, the stock plunged. How bad was it?

By the time of the announcement, the stock was traded at approximately $101.50 and was suggesting a generally optimistic outlook. During and after the announcement, the share dropped by $10, losing 10% of its value. On the next day, it continued the decline and touched the current level of $87. The continuation of the downward trend was fueled by similarly dramatic results of other financial titans such as Bank of America and Citigroup, who also reported on Wednesday.

Therefore, until now, a total of 15% reduction is the reaction of JPMorgan to its financial results. Is it bad? Looks like it is, but let’s see other banks as well.

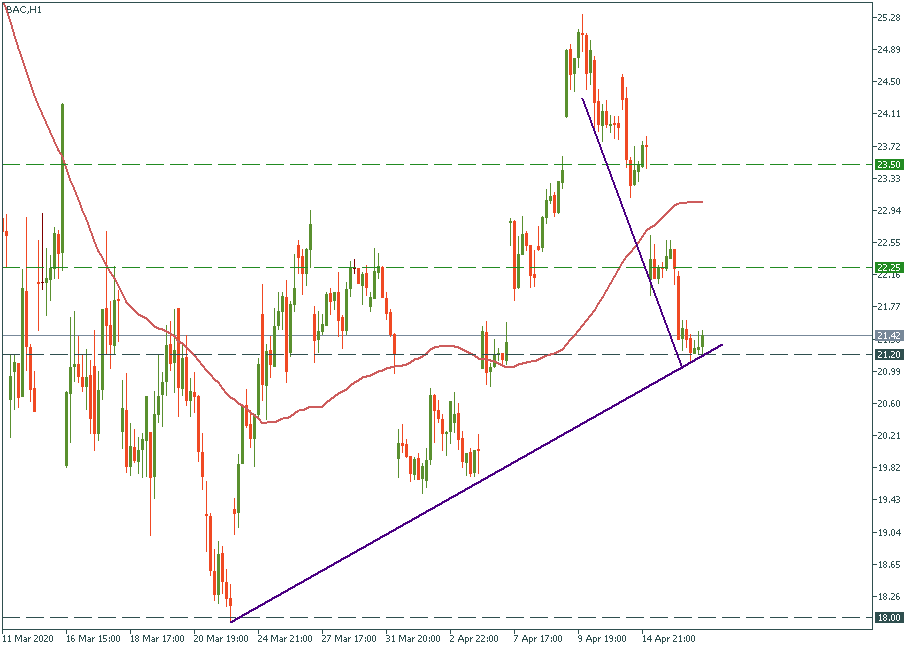

Bank of America brought a $0.4 EPS, which was slightly lower than the $0.42 forecast and 46% less than the EPS of the previous quarter. So it gave a bit lighter picture, but still, showed substantial damage ot the corporate performance.

The stock reacted in a similar way. It dropped from $23.50 to $22.25 on the day of the report and continued its way down to $21.20 the next day, making a total of 10% reduction in the share price from where it was before the announcement. It’s clearly better than a 15% reduction of JPMorgan but still a notable decline.

Citi’s share showed a similar 10% reduction in value dropping from $45 to the current $40. The bank’s EPS reported on April 15 was $1.06, which is 44% lower than the EPS of the previous quarter and almost 20% higher than what the market thought it would be. In other words, bad, but not that bad.

As you have noticed with all the three banks, their reports made the prices drop by 10-15%, but none of them broke the tactical upward trend, which is there since the middle of March and is believed to be the path of the stock market’s recovery. Even JPMorgan, which was the first to come with its lower-than-expected devastating results, like a harbinger of destruction, did not break the key barrier. It is testing that support, like the rest of the banks, but still, it hasn’t shown a strong desire to go below it.

Most probably, investors are weighing the risks for the rest of the industry to be pressed by the burden of big debts and unpayable loans, a result of the virus hit. The fact that the marked support is actually acting as support means that things are not that bad. Otherwise, the share prices would not even make that stop where they are now. “We’ll see if that goes on”, one may say. That’s fair enough, but as of now, we can state that the financial sector absorbed the punch and looks like staying straight. In the meantime, lear how to trade CFDs to make sure extract the maximum from trading stocks.

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Tampaknya drama di antara para pengguna Reddit dan firma-firma dana lindung nilai Wall Street telah mereda sejak awal minggu ini.

Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!