Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

2022-06-06 • Dikemaskini

What is tapering?

Tapering is the reduction of the rate at which a central bank buys new assets. It is mostly used when talking about the reversal of quantitative easing (QE) policies and is regarded as the first step in winding down from a period of monetary stimulus. Tapering is just another tool used by central banks to control interest rates and the perception of future rates.

Tapering impacts interest rates almost immediately. QE policies lower the interest rate, so when the purchasing program is reduced, interest rates will rise again.

Tapering leads to deflation, pulling money out of the system and making the cost of living more affordable but increases unemployment.

Tapering often leads to fears that liquidity would decline since investors await the global market's upcoming collapse.

In the long term, banks benefit from the rate hike through the higher net interest income on loans and borrowings.

On the other hand, in short term, high inflation leads to a decrease in real incomes of the population and a decrease in demand for loans and borrowings, which is the main income for banks.

Another reason why the banking sector may suffer is a decrease in market liquidity. If people make fewer operations on financial markets, banks will get less income from their investment and brokerage directions.

JPM, daily chart

JPM dropped to its 100 daily moving average. We expect this downtrend to continue right after this support line will be broken through. Targets are $147 (the 200-day moving average) and $140 (JPM’s highest pre-pandemic price).

Citigroup, weekly chart

Citigroup demonstrated a worse dynamic than JP. Morgan during the period of pandemic recovery. The closest resistance level is $71, we don’t expect the price to rise higher than that level. On the contrary, we believe that in the middle term the price will reach $66 and $62, which are 200 and 100-weekly moving averages respectively.

BAC, weekly chart

BAC’s will follow the whole sector. The price tends to reach $37.6 and $36 support levels.

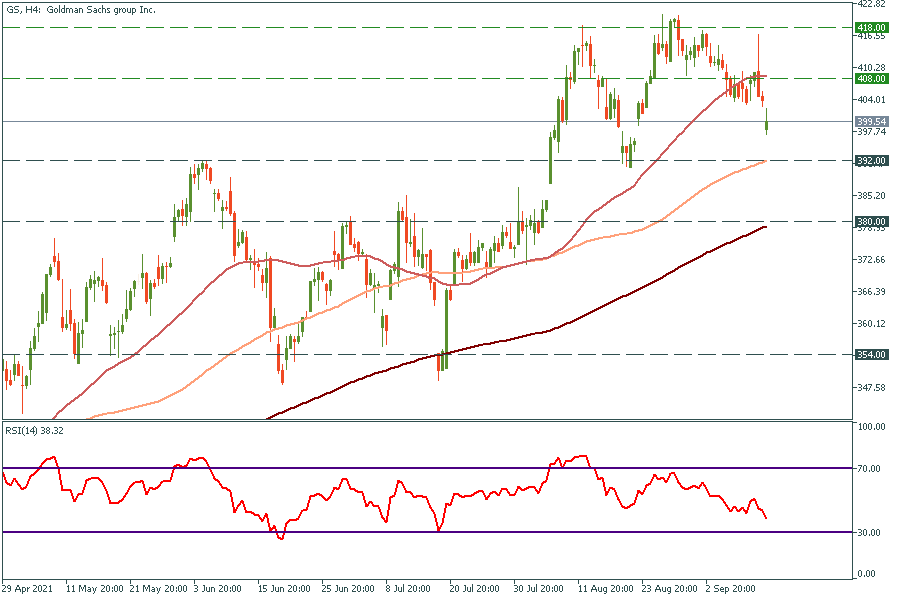

GS, weekly chart

GS has a huge divergence on a weekly chart. The price will tend to play it out and head towards $305 in the middle-term period.

In short term, there is still a downtrend. Targets are $392, $380 and $354.

Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

Menjelang bulan April, para pelabur sedang mencari peluang terbaik dalam pasaran saham. Terdapat dua industri yang berkembang pesat yang kelihatan positif untuk jangka masa terdekat; saham-saham kenderaan elektrik (EV) dan perbankan.

Apa yang akan terjadi? Walmart, sebuah syarikat peruncitan multinasional Amerika, akan membentangkan laporan perolehannya untuk suku keempat pada 17 Februari sebelum pasaran saham dibuka (16:30 GMT+2)…

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!