Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

2023-01-17 • Dikemaskini

Some traders love trading gold, others – hate. What’s the reason? Gold tends to fluctuate with a greater volatility than major currency pairs. For instance, the gold price rose almost by 7% in April, while the price of EUR/USD changed by only 0.7% in the same month. So, gold most of the time strongly sticks to the trend. If it goes up, it will continue increasing for a long time, and vice versa. You’ll be able to double or triple your account, if you catch the right impulse, but be cautious and always remember about the risk management and put stop losses. Also, there are some strategies that can help you to avoid the gold pitfall.

When one of these factors happens, the gold price tends to increase. Gold is a safe-haven asset, that’s why investors buy gold to preserve their capitals from loss in times of the market uncertainty and risk-off sentiment. For example, these days you can notice that the gold price reached unseen levels amid the coronavirus pandemic. We even got two factors that pushed gold upward: economic crisis and low interest rates.

Trade breakouts in the direction of the long-term trend. Here is the rule: when the monthly closing price of gold is the highest it has been in six months, that is a bullish signal, so you may consider going long on XAU/USD. In opposite, when the monthly closing price is the lowest it has been in 6 months, that is a bearish signal.

There is some statistical data that the gold price tends to increase in some months of the year and decrease in others. You shouldn’t base your analysis only on that, but it can give you an extra hint. Gold mostly rises from September to May and falls from June to August. Of course, these are generalities. Not every year the gold price repeats the same seasonal movements. It’s really important to follow news and monitor price movements on the chart.

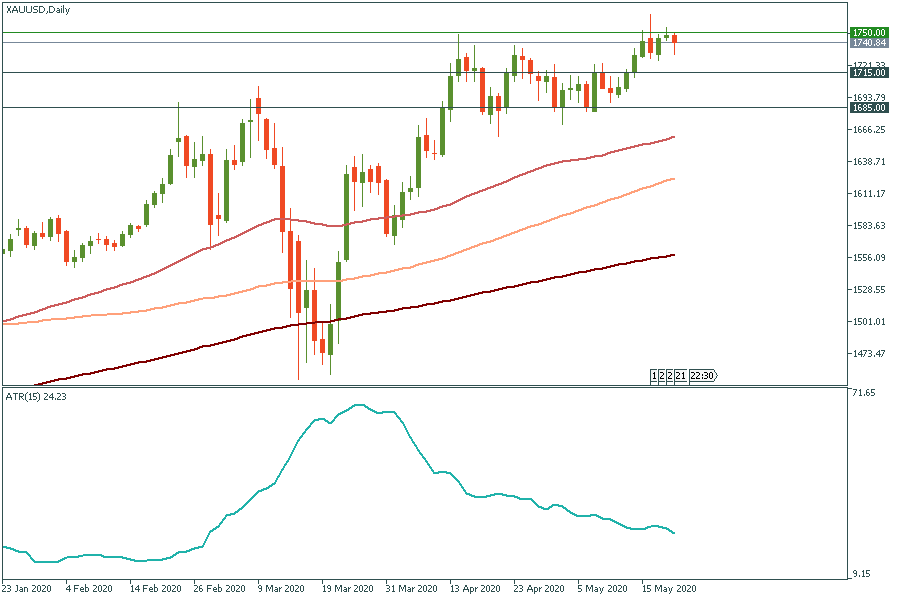

It has been already mentioned above that volatility really matters for trading gold. That’s why the Average True Range (ATR) indicator can really help to find entry points. What you need to do is simply open the daily XAU/USD chart and insert the ATR indicator with the 15 period. If the ATR indicator goes up, the gold price will break out to new highs. Let’s look at the chart below: the ATR value isn’t increasing now, so we can assume that it won’t be any significant change in trend soon. Based on all above rules, the price may move down a bit in the short term, but the long term remains bullish. It could have a pullback to 1715 or even 1685 and then surge again to 1800.

Now you have all tools to trade gold and get profit! Also it will help you to diversify your portfolio and reduce risks.

Here you can always find fresh news and analysis about gold .

Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

Penghujung tahun semakin hampir Apakah yang akan dibawakan oleh 2021 kepada kita? Jom ketahui apakah jangkaan di fikiran bank-bank besar!

Analisis fundamental EUR/CHF

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!