Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

2020-02-18 • Dikemaskini

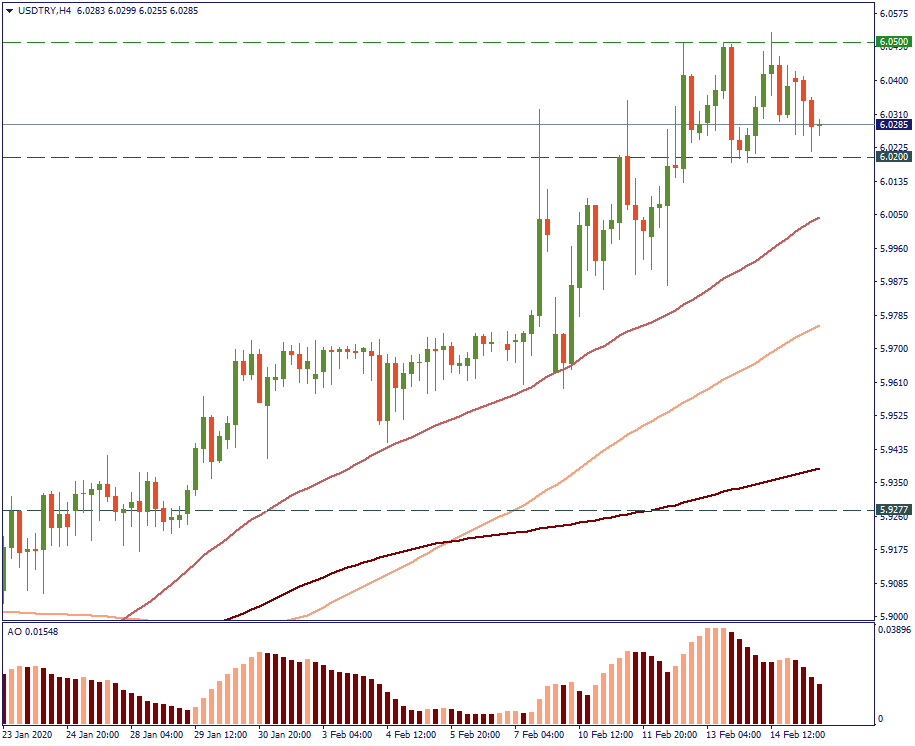

Performance in 2020: +1.6%

Last day range: 6.0177 – 6.0521

52-week range: 5.2863 – 6.2860

The Turkish lira is depreciating against the US dollar. In fact, that has been the case for more than 10 years, with the exception of the second part of 2018. The main reason for that is that the Turkish authorities are taking risky political and military maneuvers on international stage. That puts a heavy burden on the country’s economy, increases its debt and tarnishes its international image and therefore investing environment. Together, these factors make the Turkish economy slowly sink and fight double-digit inflation.

The Turkish president Recep Tayyip Erdogan is famous for being an enemy of interest rates (among other things). That’s basically why the Turkish Central Bank Governor Murat Uysal keeps slashing the interest rate and is likely to continue doing that. The inflation now is not as high as before, and formally, it gives ground for the monetary authorities to state that they are following a correct course in currency stabilization and disinflation.

However, the true reason in the actions of Mr Uysal seems to be more human than economic. His predecessor in the position of the governor of the Turkish Central Bank, Murat Cetinkaya, was fired by Erdogan for not following the Turkish President’s instructions. Such a thing never happened in the last 40 years since the time of the military coup in Turkey. That tells a lot about the true domestic environment in the country and “how far” things have gone.

In any case, such a policy, even if locally it coincides with certain positive economic factors, will probably inflict more economic damage on Turkish citizens rather than truly control the domestic economic situation. For sure, it will make Turkey lose financial and investment credibility on international scale - Fitch rates it at BB- now.

Not that any analyst was in a position to suggest anything, but it doesn’t take a genius to predict little good for the country where economic authorities prefer bowing to the dictation of political leaders rather than standing truly economic grounds. Probably, to understand the inner working of the Turkish Central Bank, we have to take into account the traditional reluctance of Middle Eastern leaders to follow the path of consultation and deliberation in decision making. Including the economic ones. However, even so, it is unlikely that Mustafa Kemal Ataturk, the founder of the Republic of Turkey (you see him on every banknote of the Turkish lira), would approve pressing on the image of “strong Turkey” on international stage at the cost of long-term economic well-being of his country. In fact, while Ataturk abstained from taking part in any military conflict and got himself busy with building a new republic, Erdogan seems to choose “we’re in” approach in almost every military conflict in the region to boost his image in the eyes of his electorate. You may say "But Trump also does it!". Well, is Turkey as rich as the US to pay for the political games of its country leader? You guess.

Resistance 6.05

Support 6.02

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Penghujung tahun semakin hampir Apakah yang akan dibawakan oleh 2021 kepada kita? Jom ketahui apakah jangkaan di fikiran bank-bank besar!

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!