Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

2020-04-06 • Dikemaskini

The USD/CAD price has been falling down since March 19. What are the reasons?

Just in case you don’t know, the Canadian dollar is also called ‘loonie’ because of the appearance of a loon (a North American bird) on the back of the 1 Canadian dollar coin. So, when you analyze it, you should consider that the loonie hugely depends on the oil price as Canada is the fourth largest producer and exporter of oil in the world. Of this, 96% of Canada’s oil exports go to the U.S. and the remaining 4% go to Europe and Asia. Because of the tight trading relationship between Canada and the US, traders of the Canadian dollar should watch the events in the United States.

In other words, if the oil price goes up, the Canadian dollar will appreciate, and in opposite, if the oil price goes down, the Canadian dollar will depreciate.

The Canadian dollar exchange rate volatility remains high as there are a lot of doubts about the oil price and the loss of the economic activity because of the coronavirus outbreak.

Moreover, today the Bank of Canada will publish its business outlook survey, which is quite significant as it helps to predict future economic conditions. Miserable numbers will hit the Canadian economy and push the loonie downward.

The loonie plummeted hugely during the first half of the March, but after it showed a bit of relief due to the global central banks liquidity measures and the increase of the oil price.

The crude prices dipped enormously in March because of a decreased demand and unlimited supply caused by the price war between Russia and Saudi Arabia. The surge of the WTI oil price happened due to Donald Trump’s tweets. He wrote that Russia and Saudi Arabia would cut the oil supply soon. So, now we wait for OPEC+ meeting that has been postponed to Thursday.

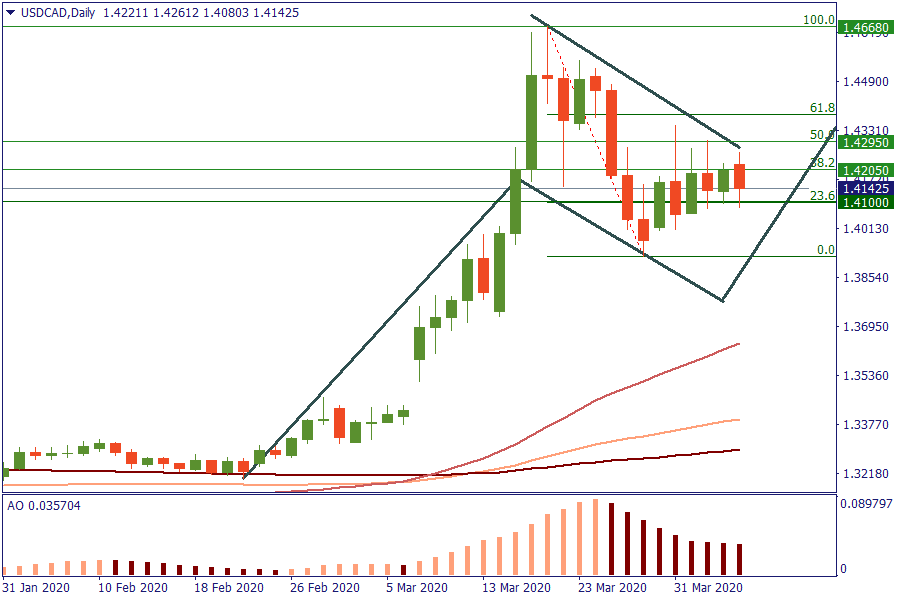

Let’s look at the USD/CAD chart below. It has been declining since March 19. However, this decline may turn out to be a bullish flag. An advance above 1.43 will lead to another rally higher. Now it’s at the 1.41425. There is a support line at the 1.41 mark and two resistant lines at 1.4205 and 1.4295.

We could assume that the worst is not over yet for the CAD even as major oil producers are moving closer to an agreement to cut production. The USD/CAD is likely to retest the recent high at 1.4668.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Penghujung tahun semakin hampir Apakah yang akan dibawakan oleh 2021 kepada kita? Jom ketahui apakah jangkaan di fikiran bank-bank besar!

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!