Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

2022-03-31 • Dikemaskini

The second day of the FBS Trading Marathon is all about stocks and indices. Luckily for you, there are several amazing trading opportunities on the stock market. Read the article and catch them all!

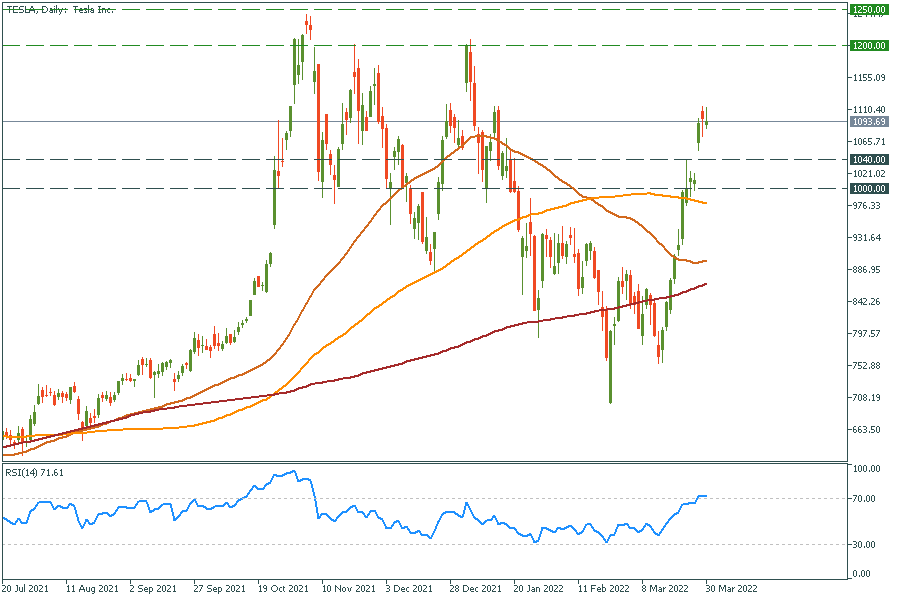

Tesla Inc. (TESLA) surge has several reasons. First, the company started to deliver cars from its new Berlin factory. Many investors were worried that the factory won’t start its work because of “red tape and bureaucracy” but now fears are shrinking. A similar event is planned next week at Tesla's other new plant near Austin, Texas, which has already started deliveries. The two factories double the number of automotive assembly plants.

Next, there are reports that Tesla has signed a secret multi-year deal with Vale for the supply of nickel. This will help Tesla to avoid supply shortages from Russia, one of the biggest producers of nickel.

Finally, Tesla shareholders are about to vote for a stock split. The company last split its stock in August 2020. The shares gained 300% since that 5-for-1 split. Stock split opens a way for retail investors to buy more affordable shares. Thus, the stock may rise even more from the current level ($1093) or a little bit lower ($1040-1000 area). The target for a movement is $1200-1250.

Tesla daily chart

Support: 1040, 1000

Resistance: 1200, 1250

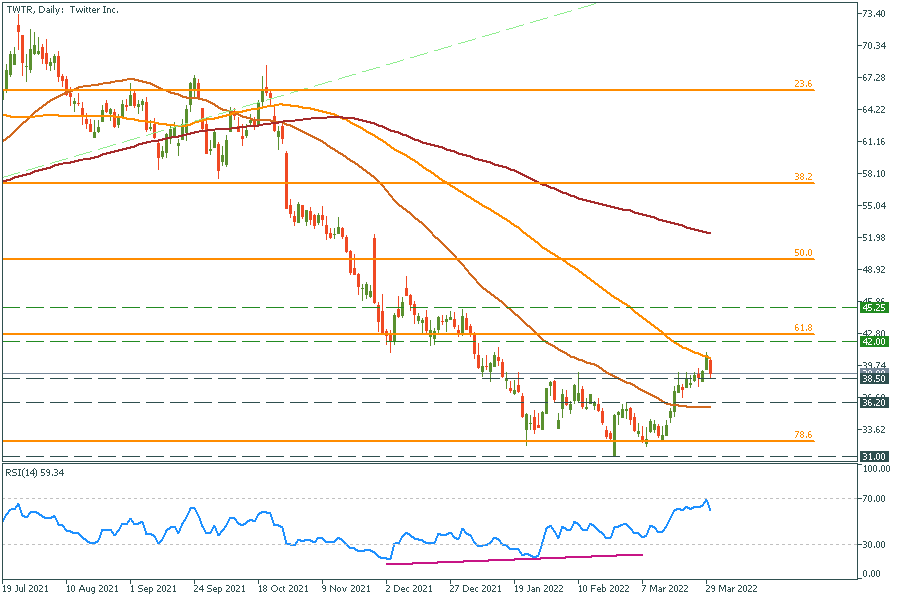

Twitter (TWTR) allowed its users to use their NFTs as profile pictures. Now you can show the world what crypto you have. Though it isn’t a major bullish factor for the stock, Twitter has an ace in the hole. The company started to accept donations in crypto, meaning that Twitter now can benefit from the growth of cryptocurrency users.

In the light of developments, the stock gained 32% over the last month and is likely to grow even more. Look for $42.00 per share as the next target.

Twitter daily chart

Support: 38.50, 36.20, 31.00

Resistance: 42.00, 45.25

After almost a two-year-long fall of Alibaba stock (ALIBABA), it is about to make a decent upwards move. Technically, we have several reasons for it, starting from a divergence on the daily RSI oscillator, ending with the fourth touch of a descending trendline.

Look for a breakout of the $124.00 resistance level and aim for gap closing of the $148.50-159.00 area.

Alibaba daily chart

Resistance: 124.00, 148.50, 159.00, 183.00

Support: 110.00, 87.00

Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

Menjelang bulan April, para pelabur sedang mencari peluang terbaik dalam pasaran saham. Terdapat dua industri yang berkembang pesat yang kelihatan positif untuk jangka masa terdekat; saham-saham kenderaan elektrik (EV) dan perbankan.

Apa yang akan terjadi? Walmart, sebuah syarikat peruncitan multinasional Amerika, akan membentangkan laporan perolehannya untuk suku keempat pada 17 Februari sebelum pasaran saham dibuka (16:30 GMT+2)…

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!