Gas asli adalah tiang seri ekonomi Eropah.

2022-12-16 • Dikemaskini

The German index has been following the scenario of the world equities. The recovery which started in March now reached a crucial point at 11,200. The index has already made several attempts to break this level, but the muted risk sentiment was limiting bulls’ ability to overpass it. How high are the chances of a breakout?

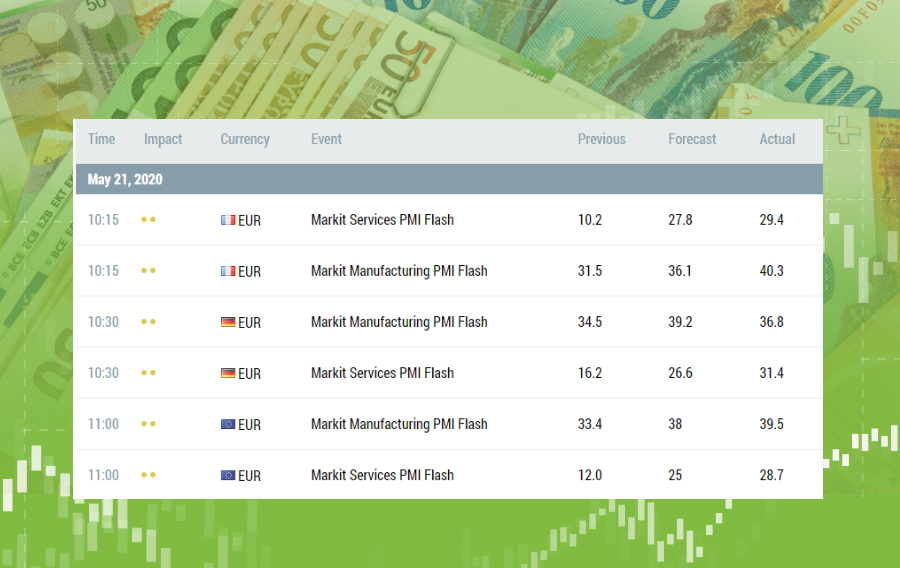

The European indicators surprised us positively during the last two weeks. While the surplus of the European trade balance increased by 23.5B (vs. 17.2B expected), the PMI releases on May 21 also showed better figures than analysts’ expectations. They indicate that purchasing managers in Europe become more optimistic about business conditions. There are actual reasons behind this improvement: the European economies are slowly awakening while easing the restrictions caused by a coronavirus.

However, better economic performance has done little for the European stock market and the DAX30 in particular. The overall cautiousness rules the market with fresh risks caused by US-China tensions and the fear of the second wave of Covid-19.

On the daily chart, DAX30 continues moving within an ascending trading channel. The index bounced off the 11,200 level and started the trading session on Friday with a gap down. Given uncertainties and the absence of important economic indicators for the Eurozone, the index may continue trading close to this level at least until the end of May. In case of positive news (for example, vaccine's approval), buyers will rush above 11,200 towards the next resistance at 11,400. The correction to the downside may be a lucky chance for bears. They will be looking for a test of 10,500 – a lower border of the ascending channel. The next support for them will be placed at 10,200.

DAX30 is traded as CFD futures contract in MT4 and MT5. You need to choose DAX30-20M in order to open a position.

Gas asli adalah tiang seri ekonomi Eropah.

Ya, harga minyak sedang terbakar menyala-nyala sekarang, dan, akibatnya, inflasi semakin memanas di seluruh dunia. Namun begitu, momentum kenaikan harga minyak sedang terancam.

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!