Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

2023-03-09 • Dikemaskini

Electronic Arts will post the earnings data on Wednesday at 00:00 MT time (after the market closes).

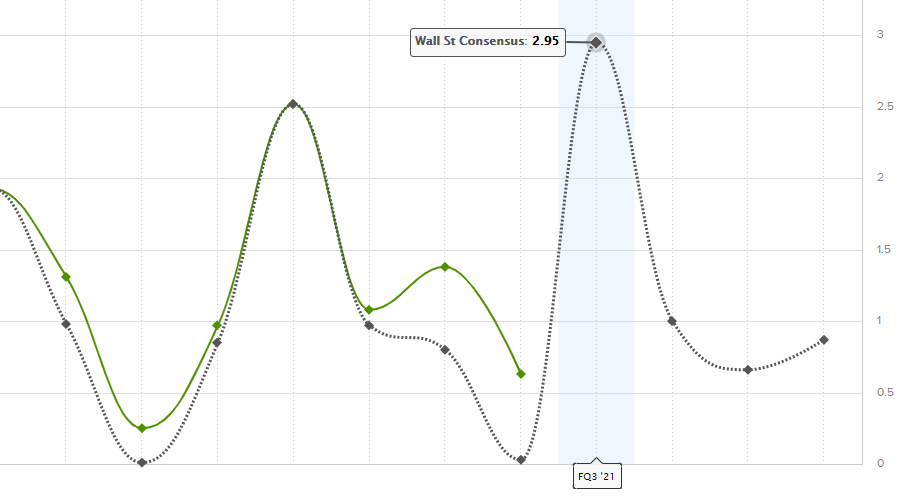

Analysts expect EPS at 2.95 and revenue at $2,386. The chart below shows us that the expectations are higher compared to the previous two years. Looks impressive, right?

Sourced by: Estimize

The EA’s stock has been recently added to the FBS MT5 terminal. Let’s see what’s so interesting about this company and its stock, and how you can take advantage out of its financial results.

Electronic Arts, or simply EA, is a famous American videogame producer. It is the second-largest gaming company in the United States and Europe by revenue and market capitalization after Activision Blizzard. Its top games are Battlefield, Need for Speed, The Sims, Medal of Honor, Command & Conquer, Dead Space, and many more. The company is included in NASDAQ and S&P500. As we can see, there are plenty of reasons to trade the stock of EA now. Let’s look at its fundamental background in more detail.

The company survived the pandemic pretty well amid increased demand for games. It has jumped from its pre-Covid levels of around $110 to the all-time high of $150. The company benefited from in-game spending and more subscriptions that helped it to initiate its first dividend at the end of 2020.

Another positive factor is the launch of Xbox X by Microsoft. You may wonder what this news has to do with Electronic Arts. The thing is, the new Xbox’s cloud gaming Xbox Game Pass Ultimate provides access to EA Play – a platform with dozens of games from EA's catalog, including, but not limited to FIFA 20 and Madden. EA Play currently represents a small part of the game developer's business. At the same time, it's one of the most perspective factors for a long-term investment.

As for new games, the company plans to launch at least six of them on the Xbox Series X and PlayStation 5. We expect a new Battlefield and Need for Speed to be among them.

The fundamental outlook is glowing, but what about the technical picture? After reaching the all-time high of $150 last week, the stock was driven down by the selling pressure in the stock market. On Friday, it bounced off the ascending trendline but the upside momentum was limited by the $144 level. If the earnings outperform forecasts from Wall Street, the stock will break the resistance at the $144 level and aim to retest the high of $150. Alternatively, we expect a plunge towards $136.4 with the following breakout to $130.

You can also trade EA’s stock with FBS Trader mobile app. Remember that stock trading starts as the US session begins (at 16:30 MT time).

Don't know how to trade stocks? Here are some simple steps.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!