Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

2020-04-20 • Dikemaskini

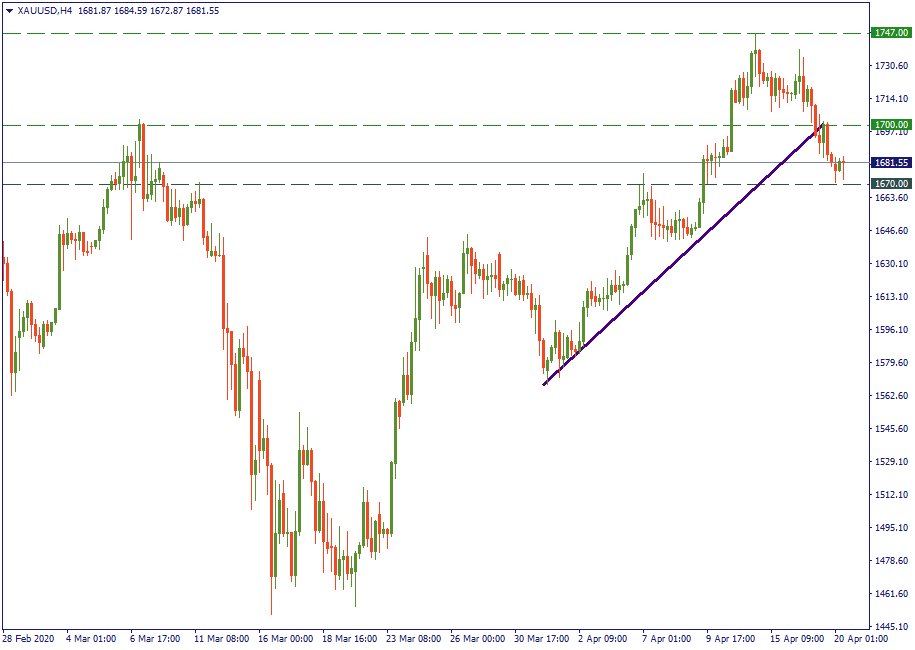

After a “wake-up call” at the end of March, gold has taken a confident upward-looking trajectory. It gradually rose in value from $1,580 to almost $1,750 last week, which made it the apple of the investors’ eyes. Currently, however, it is back down at $1,670, which breaks the previous uptrend and suggests a more lateral, although still volatile, path. What’s going on?

The main reason claimed by most observers when explaining the drop in gold price is the difference between the prices at which the metal was traded for physical delivery contracts in New York and London. As these are the two central markets for the shining metal, they largely “define” how the “universal” price for gold behaves. Therefore, a difference of $70 per ounce between gold futures traded in New York and London is a serious discrepancy. One may say “This difference would quickly go to zero with speculators taking advantage of the situation - what’s the problem for them to buy gold in London and sell in New York at a price $70 higher? That would stabilize gold price and set it back upwards!” Let’s remember we are speaking about futures for physical gold delivery, and that faces a number of problems if we consider linking the two markets in real trade. Even without the coronavirus disruptions, it would be difficult to manage such an arbitrage. Hence, no rapid solution could have been provided – thankfully (for gold traders), the spread between Ney York and London gold prices narrowed to $20 per ounce last Friday.

Observers comment that gold is likely to trade between $1,500 and $1,750 within the next two to five years while the world will be on a recovery course. Spikes up to $1,800 and even $2,000 per ounce are expected. Let’s remember that fundamentals are primary factors with gold, and the main fundamental factor for the nearest future will be uncertainty about how/when/whether the world regions will regain their powers and capacities. For gold, that should be almost like a guarantee for rising higher.

Therefore, the current channel between $1,670 and $1,700 where the gold price is currently contained is likely to be a temporary sideway stop before a possible further increase in value. However, keep in mind that, although $2,000 was voiced out as a possible mark, $1,700 - $1,750 is in the higher range of the predicted performance area. For this reason, expect frequent breakouts from this upper level down to $1,600 - $1,650 in the long run.

Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

Penghujung tahun semakin hampir Apakah yang akan dibawakan oleh 2021 kepada kita? Jom ketahui apakah jangkaan di fikiran bank-bank besar!

Analisis fundamental EUR/CHF

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!