Tampaknya drama di antara para pengguna Reddit dan firma-firma dana lindung nilai Wall Street telah mereda sejak awal minggu ini.

2019-11-11 • Dikemaskini

The Singapore dollar starts to attract more attention from different analysts. Why does the youngest currency in the world become a subject of interest for them and what are the long-term forecasts?

What factors may affect the SGD?

The Singapore currency is easily affected by the events in the global market. As Singapore is a small open economy that depends on trade, the trade war has been affecting the SGD heavily during the previous year. The recent optimism on the extension of the trade truce between the US and China pushed the currency to the new highs. If the sides reach a trade agreement soon, the SGD will go up.

The Monetary Authority of Singapore (MAS) manages its monetary policy using the exchange rates rather than interest rates. The regulator allows the exchange rate to fluctuate within the predetermined range. During the last October’s meeting, the central bank tightened its monetary policy and allowed the Singapore currency to appreciate. Some of the analysts expect the MAS to tighten its economy further during the next meeting in April, referring to the high levels of core inflation at 1.7% in January. Others are uncertain about the next step by the central bank due to the global slowdown. The final decision by the central bank in April may bring volatility to the Singapore dollar.

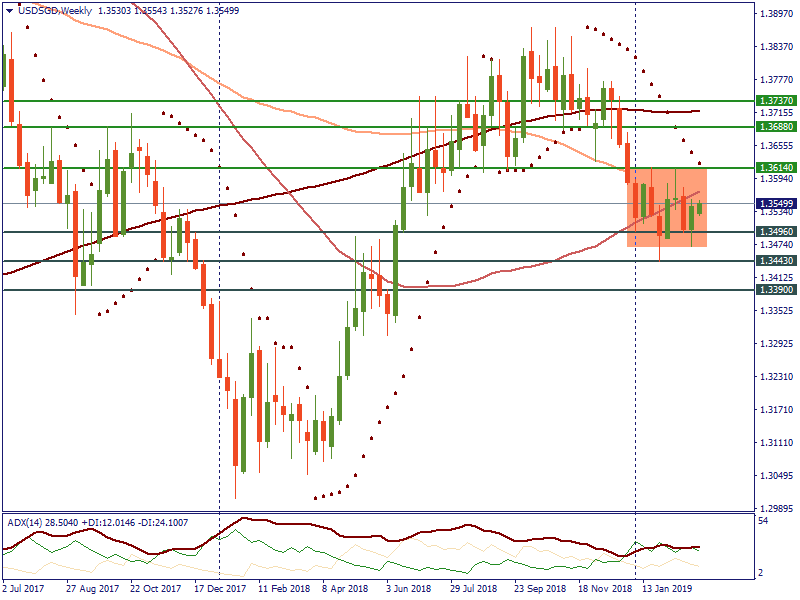

Key levels for the Singapore dollar

As we can see on the weekly chart, the Singapore dollar has been trading sideways since the beginning of the year between the 1.3614 and 1.3496 levels. Strong USD made the pair rise towards the 50-week SMA in the last two weeks. In case of risk aversion, the pair will face the resistance at 1.3614. If bulls manage to break this level, the next resistance will lie at 1.3688. If the MAS is dovish, the next level in bulls’ focus will be placed at 1.3737. On the other hand, if the trade deal between the US and China is successfully reached, USD/SGD will break the support at 1.3496 and target the next support at 1.3443. The third key support for bears is situated at 1.3390. This level may be reached if the MAS surprises the market with a hawkish statement. From the technical side, Parabolic SAR shows a downward movement for the pair and ADX demonstrates increasing bearish strength in the market. That means the Singapore dollar may strengthen soon.

Conclusion

The next couple of months will definitely bring us some chances to trade the Singapore dollar. That is why we recommend you to follow it more attentively.

Tampaknya drama di antara para pengguna Reddit dan firma-firma dana lindung nilai Wall Street telah mereda sejak awal minggu ini.

Brexit selesai. Apa yang akan terjadi pada ekonomi UK dan pound? Ketahui di dalam artikel kami.

Laporan perolehan akan menunjukkan prestasi syarikat pada suku tahun ketiga.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!