Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

2020-01-08 • Dikemaskini

These days may seem a little out of order to the oil price in light of the happenings between the US and Iran. This gives more reason to have a fresh look at the chart. But first, let us recollect the logic of the events.

On Friday, the news about the killed Iranian commander Soleimani reached the media. Markets were slow to react, then shocked, oil panicked.

On Sunday, the US President Donald Trump warned Iran against any retaliation; oil was still panicking.

On Monday, he said Iran never would have a nuclear weapon in reply to the surging note that the abandoned nuclear deal is the true background of the conflict; oil price was still falling down.

On Tuesday, Iran voiced out the coming retaliation; oil price kept falling.

Today, we hear that Iranian missiles hit the US airbases in Iraq; oil price panics again; President Trump reassures “all well” and says he would get back to us. Later during the day, we discover that none of the Americans or the Coalition forces were actually hit but the missiles. Moreover, we get reports that the retaliation strike was brilliantly managed by Iran to make sure it is big enough to satisfy the domestic vindictive mood among the Iranians but harmless enough to provoke the US to get back with a serious response.

No surprise, this flow of news forces the oil price to deviate from its’ “normal” trajectory. But does it actually?

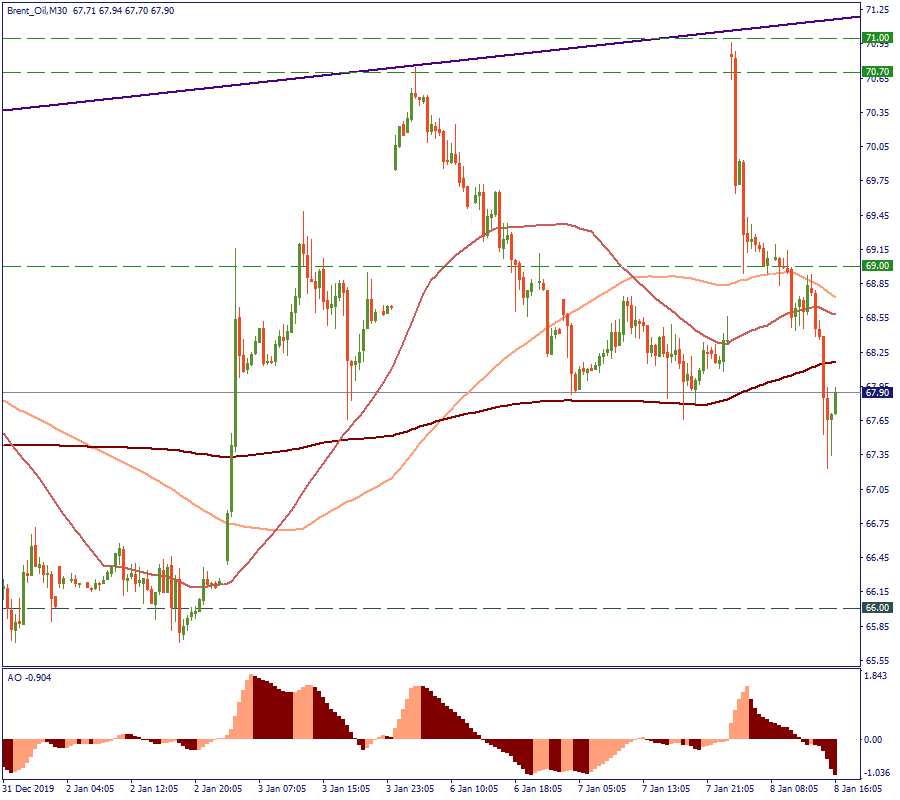

A short-term picture gives a shaky impression indeed. After the door of $70 per barrel on Monday, Brent secures this position today at $71, which is unseen since May 2019. But then, it falls down as if nothing happened and breaks through all short-term support levels along with the 50-period, 100-period, and 200-period MAs. Only the Awesome Oscillator consoles with a seemingly reached bottom.

In the meantime, the long-term picture puts things in order. Yes, we see some “red volatility” at the end of the chart, but the trajectory did not deviate much from the general upward trend visible since October. Hence, even before the statement of the US President, we can have some certainty that the observed uptrend needs more to be challenged. Very likely, Brent oil price will secure its positions closer to the current level of $70 and then look for more strategic factors to follow.

The noise is the natural component of the market’s daily life. If you can trade the rumors, you have plenty of opportunities to do that, as these days have shown. Otherwise, make verified trade decisions, learn the techniques and follow the news.

Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

Powell mahukan pendaratan yang lembut untuk inflasi, seperti yang dilakukan oleh Greenspan pada tahun 1994. Tetapi nampaknya dia akan menempuh satu pendaratan yang sukar.

Era wang murah COVID-19 sudah berakhir. Siapakah yang takut terhadap kitaran pengetatan Fed? Nampaknya bukanlah para pelabur saham.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!