Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

2020-03-13 • Dikemaskini

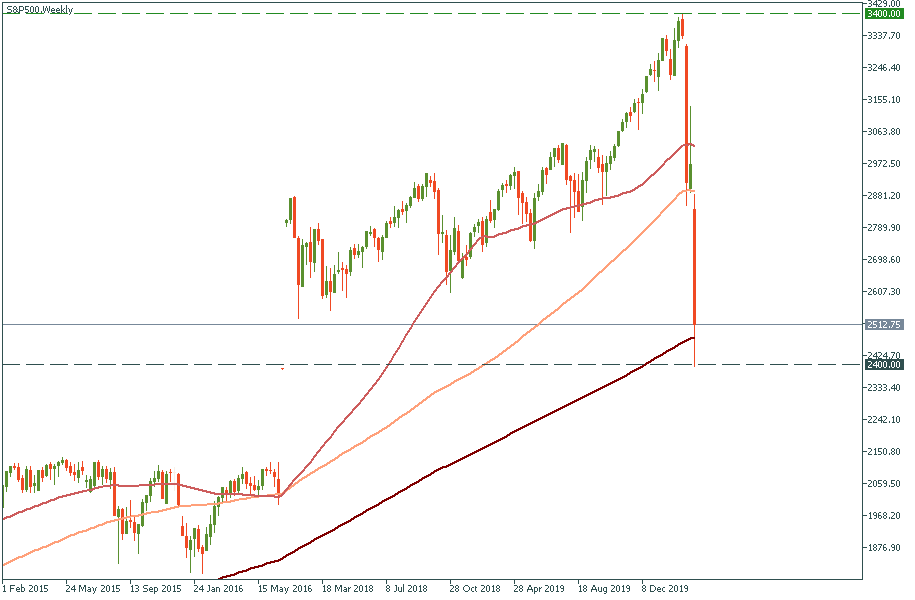

On the weekly chart, we see a drastic drop that S&P 500 did during the last month. From its all-time high at 3400 reached in February, the American stock market’s major index fell to 2400, losing almost 30% in value.

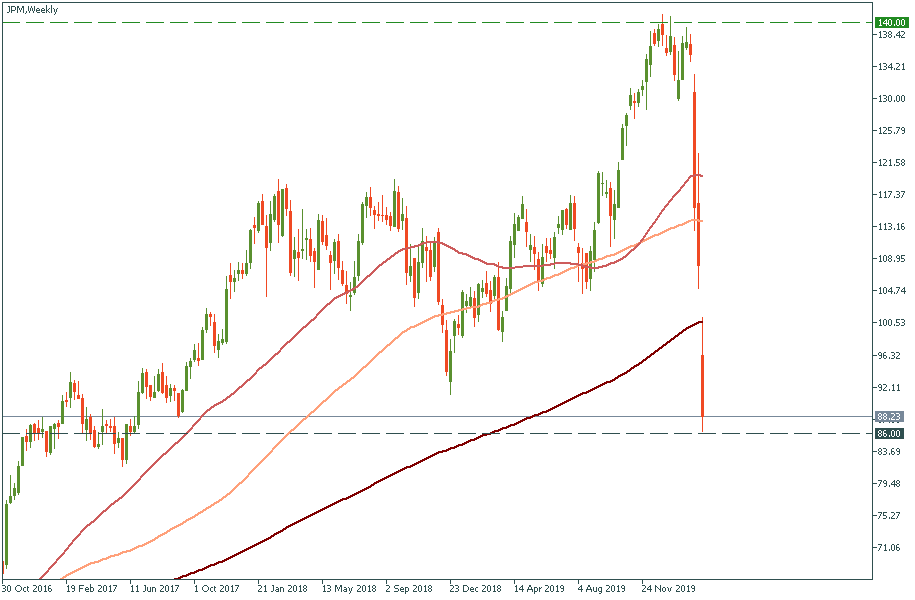

That represents the recent dynamics for most of the major public companies presented in the US stock market. For example, JPM, one of the core players in the financial sector, shows a very similar pattern on the chart below.

Its recent all-time high at $140 per share was quickly left behind, and the low of $86 was reached, now serving as local support. It is a 38% drop, even a bigger loss than that of the S&P 500. We have to note, though, that this is more of a red-zone end of the spectrum: most of the companies show either similar or milder intensity of depreciation as compared to the market average. Still, the overall picture is quite the same.

Fundamentals say that we are far from reaching the last episode of the global downturn saga. Coronavirus, although slowing down in China, is knocking at the doors of the EU and the US. On the one hand, that is good news, at least, for China – we know that this country has seen the worst stage of the outbreak and now only has to “safely” put itself back together. On the other hand, when you see the highest American officials doing an “elbow bump” instead of a handshake to lower the risk of infection, you start thinking that if the virus expands to the same ugly proportion as it did in China, say, leading to a forced quarantine and facilities closure in an industry-heavy state, you get a bit scared.

In Europe, the ECB failed to present on Thursday any meaningful measures to counter the economic damage of the virus. At least, that was a market impression, which was confirmed by a quick and rare backfire from - no, not the German officials - the French President Emmanuel Macron. Christine Lagarde announced that the interest rate would stay at the same level of 0%, going against a lot of forecasts and, more correctly, hopes. She also pointed out certain actions within the monetary ease direction, which the ECB is about to take. Specifically, the European Central Bank is planning to buy more bonds and extend a loan program aimed at improving the Eurozone’s banks conditions and stimulating them to inject money into the economy instead of keeping it parked. Mainly, that made the public think that the ECB indirectly confirms that it has its levers all but exhausted and now pushes for the local governments to take on the responsibility of fighting off the risks of a recession. In Macron’s own words: “The ECB…shared its first decisions. Will they be enough? I don’t think so”. Exactly, neither does the market.

A similar weak impression is applicable to US President Donald Trump who recently banned all travel from the EU for 30 days and announced certain fiscal and tax assistance to the businesses. Most of the observers commented that, although sounding confident as any word out of the lips of Mr. Trump, the announced measures lacked detail, specification, structure, and even were in part self-contradictive. Some even led to the American authorities having to clarify and disprove certain misunderstandings arising from the US President’s speech. Overall, the market got the impression that the US authorities are lagging behind with their response. In the meantime, the Q2-2020 economic results are now expected to be significantly lower than expected.

In this environment, for a trader, its quite easy to get scared, shocked, to panic and eventually stop any trading activity thinking “I’ll better stay aside”. Is that a good response? Not sure. But certainly, that’s a response that deprives you of an opportunity to gain. “To gain in the falling market?”, you ask? Yes, that’s what makes Forex with CFDs different from the stock market. In the latter, you buy or sell real stock; if you don’t have stock, you cannot sell it and gain on its falling (“tricks” aside); if you have it and it drops – you just lose. But with CFDs, you do not trade real stock – you trade an expected price of a stock. Therefore, if you see it fall and can make a good guess where it reaches, then you can make profits on that – same like you do with currencies.

For this reason, the stock market provides an excellent opportunity to gain profits as it becomes relatively predictable due to the fundamentals available. The gravity of the global situation described above merely means that you have a guaranteed probability of the stock market to keep falling: as long as the virus, economic damage, and the oil price war are out there, it will be under pressure. Hence, the stocks will be under pressure. Thus, you have a fundamental certainty of the general trend. Now, you only have to add some technical prowess to it and calculate market entry points – in here, you do nothing else than the usual way to open a position. Whichever method you use, say, 30-pips-a-day or Base-150 strategy or any other – keep using it, and don’t make the crisis push you into a mental state of exceptions. There are no exceptions - just the conditions are more intense. The method stays the same, and in fact, the current situation may provide greater ground to prove and test your strategies than a usual healthy market.

They say, trying to buy an asset when its price collapses is like catching a falling knife. That’s because you may see it fall further and lose your funds on the way. Therefore, make no exceptions to your usual strategy – go with the trend. If the trend goes down, you sell. Once it hits the bottom and reverts upwards, you buy – same as always.

In case you want to make sure you know all you need about CFDs - this article will give you the essentials. Knowledge conquers all!

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Tampaknya drama di antara para pengguna Reddit dan firma-firma dana lindung nilai Wall Street telah mereda sejak awal minggu ini.

Laporan perolehan akan menunjukkan prestasi syarikat pada suku tahun ketiga.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!