Gas asli adalah tiang seri ekonomi Eropah.

2021-08-11 • Dikemaskini

1. USD/CHF and EUR/CHF are on the bullish rally for over a week.

2. Swiss National Bank (SNB) assessed the franc to be “highly valued” in June, but it affected the price faintly.

We had already seen Gold Flash Crash several days before, and now it’s time to look at the EUR/CHF and USD/CHF pairs. In August Swiss franc has risen against the euro to a nine-month high of 1.072. As for now, it was the lowest point of the EUR/CHF downtrend. Yet the USD/CHF pair shows more flat movements.

The reason is that franc is considered by the majority of traders and investors as a safe-haven asset, putting it on the same level as gold and JPY. Because of low inflation and negative interest rates, CHF is strongly associated with slow but steady growth against all currencies. Investors keep buying CHF and JPY in attempts to hide from Delta’s impact on global economic growth.

Swiss National Bank paid attention to the “unstoppable” growth of franc and assessed it to be “highly valued” in June. However, this statement didn’t stop CHF rise and the currency has only strengthened 1.5% since then. The plunge in bond yields from Treasuries to bunds has also boosted the currencies’ appeal. All this raises the risks of (Swiss) Central Bank intervention with its monetary policy, including negative interest rates, and a pledge to wage currency market interventions if needed.

The question now is at what level the Swiss National Bank might intervene. It could be last year’s low at around 1.05 per euro or a little bit further at 1.03 if the SNB used a real trade-weighted measure as a guide. One thing is for sure, this kind of intervention to the natural order of things will affect badly on Swiss economy.

Maybe there won't be any intervention at all. The Swiss franc has lost about 2.5% over the last week against the dollar to trade at 0.9235 CHF and has weakened against the euro to 1.082 per EUR.

After a strong US NFP report (943K actual vs. 870K forecast) the US Federal Reserve could soon start tapering its massive coronavirus-driven stimulus. The prospect of the Fed's reduced bond-buying pushed down US bond prices, lifting their yields and hitting other safe-haven assets that had benefited from low returns from bonds, such as the Swiss franc and gold.

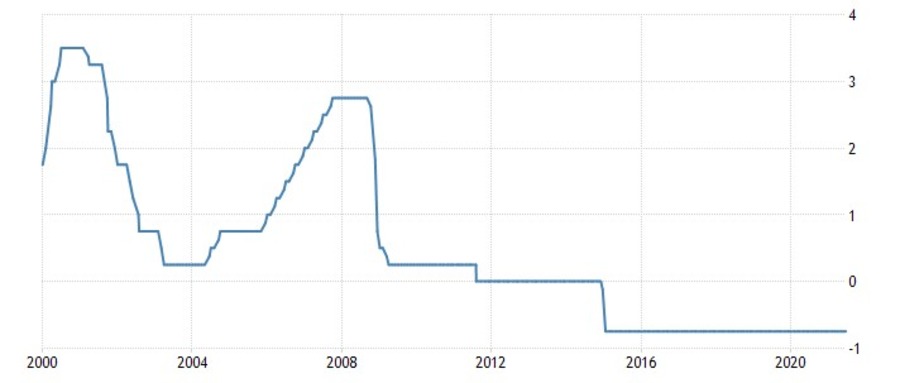

BofA Global Research says that CHF is the most vulnerable among major currencies to a recovery in U.S. bond yields. That’s because Switzerland has the lowest official cash rate in the world and some of the lowest bond yields as well. Look at the Switzerland Interest Rate hereunder.

Source: https://tradingeconomics.com/switzerland/interest-rate

Risks are rising for CHF, and yet they are limited. The European Central Bank’s latest strategy review supports the view that policy in the euro area will remain expansionary for a long time after the pandemic. Expansionary monetary policy works by expanding the money supply faster than usual or lowering short-term interest rates. In a nutshell, that means that the upside potential for the euro against the franc could therefore be limited even once Covid cases start subsiding.

The Swiss Franc is having a major week-long reversal in EUR/CHF pair, with resistances at 1.08184 and in 1.0842-1.08505 area. Beneath there is a strong support line at 1.0721.

Anyway, EUR/CHF downtrend is unlikely to change, with the “death-cross” bearish pattern have occurred a week ago. The main resistance, for now, is 1.0864 and support is at 1.0721.

As for the greenback, in the long-term CHF is rising again USD with resistance in 0.9273-0.9366 area and support at 0.896 level.

Gas asli adalah tiang seri ekonomi Eropah.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!